0xBlockBard - Picasso ($PICA) Deep Dive Research Report

The Most Comprehensive Fundamental Analysis of Picasso ($PICA) & Composable Finance

In this report, we adopt a structured step-by-step approach starting from the overview of the project, its team and roadmap, before diving deeper into the financials and tokenomics.

We also try to break down difficult concepts or technical jargon into simple and more easily understandable points that would help you in making a more astute investment decision, and ideally, saving you tens of hours in the process of doing your due diligence.

This report strives to maintain an impartial and balanced yet critical perspective. Some might perceive our analysis as conservative or skeptical, however, this cautious stance is intentional, considering the prevalence of fraud, scams, and rug-pulls in the cryptocurrency space. We believe it's better to err on the side of caution.

Given the dynamic and often volatile nature of the cryptocurrency market, it's also important to acknowledge that unforeseen developments or emergent information could significantly impact the relevance of some findings here.

Disclaimer

This report is an independent analysis and has not been sponsored or endorsed by any third party. The information provided herein is for informational purposes only and should not be construed as financial, investment, or professional advice.

The cryptocurrency market is highly volatile and unpredictable; therefore, readers are strongly encouraged to conduct their own research and due diligence, and to consult with a qualified financial advisor before making any investment decisions.

The views and opinions expressed in this report are those of the authors and do not necessarily reflect the official policy or position of any agency or company.

As of the date of publication, the authors and contributors to this report declare that they hold a small position (below $1000 USD) in $PICA tokens as discussed in this report. However, holdings are subject to change at any time without notice.

The authors and contributors bear no responsibility for any financial losses or damages resulting from the use of information contained within this report.

Outline of Analysis

For our analysis of Picasso ($PICA), we would cover the following topics below in order:

Bear in mind that these scores are purely subjective, and it’s perfectly fine for another person to have contrasting thoughts and opinions. I have also refrained from tallying up all the scores as it is more important to understand each element on its own instead of an aggregate total, which might not accurately reflect the individual significance of each component.

Project

Important Terms

Before we begin proper, there are several important entities and terms within this ecosystem that would be helpful to first understand:

Composable Cosmos Chain: This is a native chain within the Cosmos ecosystem, specifically designed for interoperability. It connects to the Picasso parachain in the Kusama network via IBC (Inter-Blockchain Communication), facilitating seamless asset transfers and cross-chain functionalities.

Composable Parachain: Residing in the Polkadot ecosystem, the Composable Parachain is built for cross-chain functionality and also utilizes IBC to connect with our Picasso parachain in the Kusama network.

Picasso: The main focus of our report, Picasso is an infrastructure layer on Kusama aiming for DeFi interoperability. Its native token is $PICA, and it connects to Composable Cosmos and Parachain via IBC.

Trustless Zone: Trustless Zone is designed to offer secure, automated, and trustless asset transfers between different blockchains.

Pablo DEX: Pablo serves as a Decentralized Exchange (DEX) and a cross-chain liquidity hub that is part of the Picasso platform. It facilitates secure and efficient trading between various assets.

Apollo: Picasso’s native Oracle

Overview

Picasso is an infrastructure layer pioneering interoperable DeFi solutions, with its native token $PICA. It is built on the Kusama network, and exists within the wider DotSama ecosystem. Picasso is highly secure, efficient, and natively interoperable due to its use of a parachain, and its proprietary technology stack.

Picasso is a project developed by Composable Finance. Composable Finance is the entity behind the creation and development of the Picasso Parachain (we may use Picasso and Picasso Parachain interchangeably).

In this relationship, Picasso serves as an integral part of Composable Finance's broader vision to innovate in the Decentralized Finance (DeFi) space.

Specifically, Picasso is designed as an infrastructure layer that contributes to Composable Finance's goal of pioneering interoperable DeFi solutions. It embodies Composable Finance's technological advancements and strategic approach to enhancing DeFi interoperability and functionality within the Kusama and Polkadot ecosystems.

The key functions of Picasso include:

Interoperability: Enables communication and asset transfers between different blockchain networks within the Kusama and Polkadot ecosystems.

CosmWasm and IBC Integration: As the only CosmWasm and IBC-enabled parachain, Picasso allows seamless integration with other parachains and Cosmos ecosystem blockchains, fostering novel DeFi strategies.

Substrate Pallets: Uses Substrate pallets for creating a customisable and efficient DeFi platform, addressing challenges like liquidity fragmentation and cross-chain communication.

Substrate pallets are modular frameworks used in the Substrate development environment. They act as core building blocks for creating blockchains. Pallets are akin to plug-and-play components that can be combined to form a blockchain's runtime environment. Developers can use existing pallets or create new ones to add specific functionalities to their blockchain projects.Cross-Chain Smart Contracts: Through Composable’s Virtual Machine (CVM), it supports non-custodial, cross-chain smart contracts, enhancing user experience across different blockchains.

Security: Benefits from Kusama's shared security model, leveraging the economic security of the Relay Chain's validators.

For further context, in Kusama’s shared security model, individual blockchains (parachains) connect to a central Relay Chain. Parachains lease a connection to the Relay Chain, and during this lease period, they benefit from the security provided by the Relay Chain's validators. This means that the economic security and robustness of the Relay Chain (backed by a large set of validators) are shared across all connected parachains, enhancing the overall security of the network.

Pallets Hosted on Picasso

As described in their medium article, Picasso hosts a robust suite of pallets, each of which has been tailored for use with assets native to different blockchains. These pallets include:

Cubic — a cross-chain vault standard

Apollo — an MEV-resistant cross-chain oracle

Pablo — a DEX that utilizes Cubic to facilitate the trade and LP of tokens originating from different chains

Angular — a cross-chain money market

Instrumental — a strategy hub that leverages Picasso to build unique cross-chain strategies

Centauri — which forms the basis of our 2nd pillar, trustless communication

Current Connections

Picasso is connected and has established interoperability with the following ecosystems below. This means a seamless transfer of data, assets, and smart contract calls between Picasso and the ecosystems listed below:

Project Business Model

The business model of Picasso, and by extension the $PICA token, revolves around creating a cross-chain interoperable platform that facilitates communication and transaction between different blockchain networks, particularly within the Polkadot and Cosmos ecosystems, and potentially Ethereum and Solana.

Here's a breakdown of the various components within to consider:

Interoperability and Infrastructure: Picasso provides a layer for cross-chain interoperability that allows different blockchain networks to interact seamlessly. This infrastructure enables users to transfer assets, information, and value across various blockchains, which is a significant utility in an increasingly multi-chain world.

Collator and Validator Rewards: In the Picasso ecosystem, collators and validators are essential for maintaining the network. They are compensated for their services with a percentage of transaction fees, and this mechanism is directly powered by the $PICA token.

Oracle Services: With Apollo, Picasso's oracle solution, $PICA is used to stake by those wishing to run oracle nodes. This contributes to the robustness of data feeds that are crucial for various DeFi applications.

Gas Fees: $PICA serves as the gas token within the Picasso network, being used to pay for transaction fees and computational services on the network, much like ETH on Ethereum.

DEX and Liquidity: $PICA is a primary token for trading pairs on Picasso's native DEX, Pablo. The platform encourages liquidity provision, for which users are rewarded, typically in $PICA tokens.

Governance: Token holders use $PICA to participate in governance decisions, influencing the direction and policies of the network. This aligns with the ethos of decentralized networks where stakeholders have a say in governance.

Treasury and Ecosystem Development: The treasury, funded by network activities and partly governed by $PICA holders, allocates resources for continuous development, community initiatives, and partnerships.

Liquid Staking: By enabling liquid staking of DOT and other assets, Picasso allows users to earn staking rewards while keeping their assets liquid, attracting users who want to earn yields without locking up their capital.

Revenue Sharing: Users staking $PICA can earn a share of the revenue generated from cross-chain transfer activities, creating a direct financial incentive to hold and use the token.

Expansion of Services: With the planned integration with Ethereum and Solana, Picasso aims to broaden its services, increasing the utility and demand for $PICA across multiple blockchain ecosystems.

The business model of Picasso, leveraging the $PICA token, is designed to capitalise on the growing demand for interoperable blockchain solutions.

By offering a suite of services that facilitate ease of transactions across chains, incentivizing network participation, and fostering a self-sustaining ecosystem through its governance and treasury systems, Picasso aims to create a robust economic loop that drives the usage and value of the $PICA token.

As the influencer Cryptocito explains, “Picasso is the IBC Hub. It’s an interoperability hub that aims to connect all chains seamlessly and the end game for Picasso is to fully abstract away the hassle of bridging, going back and forth between chains, depositing, withdrawing, all these kinds of things, and just purely focusing on providing the best UX to navigate through the interchange.”

Overall Score - Project

Team

Who’s Behind Picasso and Composable Finance

The Composable Finance and Picasso team consists of approximately 35 individuals, with 20 members dedicated to Engineering, Infrastructure, and Research, while 11 others are focused on Product, Design, Marketing, and Business Development. The remaining four individuals are assigned to Legal, Finance, and HR roles.

Key executive members would include Omar Zaki (Founder & Research Director), Blas Rodriguez Irizar (Co-Founder & CTO), and Miguel Santefé (Co-Founder & Head of Design).

Omar Zaki: Founder & Research Director

Omar is the key executive at the helm of Picasso and Composable Finance, and is described as a seasoned researcher and innovator in the blockchain industry.

He also has quite a checkered past.

In April 2019, the SEC filed a complaint against Omar for “misleading investors in financing an unregistered hedge fund” that he ran as an undergraduate at Yale. According to the SEC, Zaki and his business partner created "investor prospectuses with false trading history, investment returns and management teams.” Subsequently, Omar Zaki paid a $25k fine to settle with the SEC without admitting fault.

In Feb 2022, crypto investigator zachXBT revealed that the anon account 0xbrainjar was Omar Zaki, and had previously been involved with two projects (WARP Finance, Force DAO) with anonymous teams and suffered large hacks, and have not recovered fully since. ZachXbt also accused Zaki of being involved with Bribe Protocol, an alleged rug-pull scam.

In response, however, Omar Zaki published an open letter to the community and admitted his past mistakes. It is worth noting that he also addressed some parts of zachXBT’s thread related to the two projects WARP Finance and Force DAO as misinformation.

In Feb 2023, Zaki was accused by former CTO Karel Kubat of legal improprieties, where Kubat said that “he was resigning because the firm had not provided financial statements to him or the community and because he had no overview of the company’s financial health”. Kubat also claimed that Zaki was related to illegal Series A fundings for the company, in violation of a cease-and-desist mandate from the US SEC. In light of these claims during this period, there were also multiple key team members that quit Composable Finance.

In an AMA (ask-me-anything) session on Twitter spaces, Zaki denied all the allegations against him and the company, and asserted that all the fundraising actions happened in compliance with the law. However, he noted that “since the company is privately held, they are unable to make its financial information publicly available”.

Blas Rodriguez Irizar: Co-Founder & CTO

Blas has 8 years of experience as a Software Engineer, and started his blockchain experience at LayerTwo before moving on to Consensys where he worked on building zk-rollups. In his role at Composable, Blas oversees the Research and Engineering departments with the critical responsibility of creating the technology strategy behind Composable’s products

Miguel Santefé: Co-Founder & Head of Design

Miguel started his career in technology consultancy before founding a creative consultancy company when pursuing his passion for aesthetics and design. He has been in crypto since 2014 and has been designing applications since 2018. Previous to joining Composable, he led the creative strategy at various DeFi projects

Henry Love: Board Member & Executive Director

Henry was the Managing Partner and the Head of US operation for Fundamental Labs, a leading crypto-focused venture fund based in Singapore. Before joining Fundamental Labs, Henry also co-founded a crypto corporate venture studio, YGC, and its spin out company Executive Council Network (ECN). He joined the crypto industry by stepping in as the Chief Investment Officer at a crypto-focused family office who pioneered the industry after leaving Facebook as a top performer in the marketing, e-commerce, & strategy division.

His stated roles would be to oversee the Foundation members, guide the treasury, foster global collaboration, and seek strategic partnerships.

Glassdoor Reviews:

Composable Finance has 5 reviews with an overall score of 3.4/5. Reviews are on the extreme end with three 5-star reviews, one 1-star review, and one 2-star review - the low reviews are from external contractors, while two of the 5-star reviews are from employees, which could reflect the contrast in experiences and reviews.

Here are screenshots of the 5 reviews, in no particular order:

Source: Composable Finance Glassdoor Reviews

Ongoing Issue:

Another serious ongoing issue would be the management of unclaimed $PICA tokens from crowdloan contributors. This situation, mainly attributed to insufficient communication regarding the claim deadline, has left many contributors feeling deprived of their rightful tokens, and robbed even, following a governance decision to allocate these unclaimed assets to the Treasury.

Notably, discussions within Picasso’s OpenGov forum are currently showing a strong consensus in favour of reversing this decision. The team’s response to this controversy is critical, as it may set a precedent for ethical practices and community relations.

How the team resolves this issue could significantly impact Picasso's standing and trust within the community. A resolution that aligns with the interests and sentiments of the community could greatly reinforce the team's dedication to its stakeholders and underpin the project's integrity and prospects.

Overall:

As the principal leader of Composable Finance, our attention must be significantly directed towards CEO Omar Zaki. His history presents a complex picture; he has previously encountered issues with the U.S. Securities and Exchange Commission (SEC) and has been connected with controversial projects like Bribe Protocol.

However, it's important to note that there is also no definitive proof linking him to the gravest accusations, such as his exact role in Bribe Protocol and whether the other projects that failed were more than simply bad mismanagement. A potentially more pressing concern would be his ethical conduct and the apparent lack of financial transparency within the organization. This issue was significant enough to prompt the departure of key team members including the former CTO Karel Kebab.

It is a positive sign, however, that Omar Zaki has proactively addressed the above-mentioned points and allegations in a head-on manner in a public setting (a letter to the community, and Twitter spaces), and significant progress and developments has been made for PICA and Composable Finance since then.

In summary, while these issues do not necessarily raise immediate red flags, they do merit careful monitoring. They represent 'grey flags' - areas of concern that would change depending on any future financial imprudences or team-related issues.

Overall Score - Team

Financials and Metrics

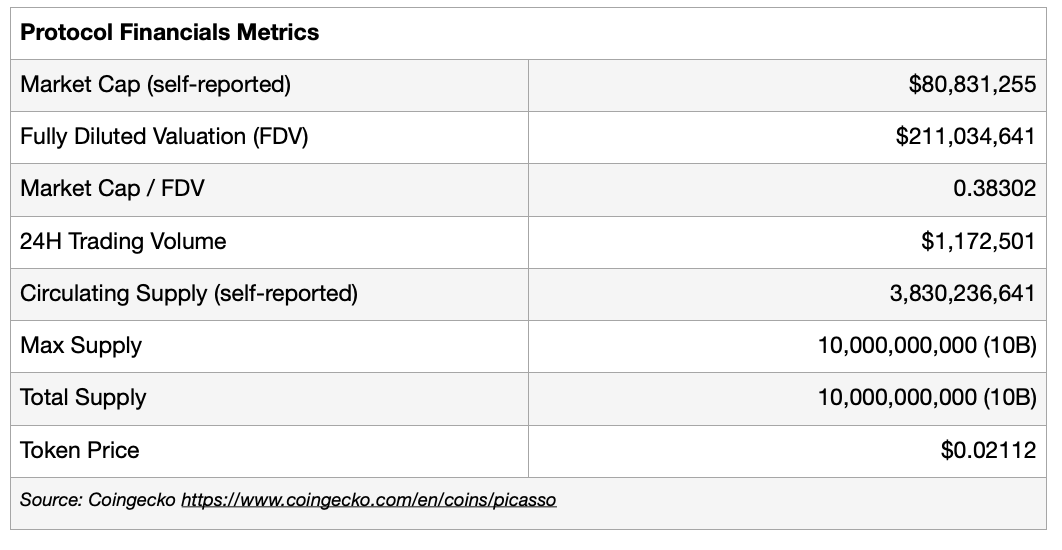

Here we’ll take a closer look at the metrics and financials of the $PICA token, based on data from CoinGecko.

What do the numbers mean?

At first glance, the market cap to FDV ratio is reasonable at 0.383 (i.e. market cap is ~38.3% of FDV), indicating that there is still room for growth as more tokens enter circulation, assuming the market price remain stable or increases.

It is worth noting at this point that the team’s self-reported circulating supply of 3.83B tokens does not seem to match with the token distribution schedule (shown below) that indicates about ~53% should be in circulation now.

This difference could possibly be explained if the tokens allocated to the other areas, such as the Treasury or Liquidity Mining, are not taken into consideration into the circulating supply. It could also be that not all the crowdloan tokens have been claimed, from what we observed in the governance forum as mentioned above. However, this is something that we would need to further clarify with the team.

Overall, the financials and metrics are fairly healthy, and the trading volume indicates liquidity and investor interest, which is positive for market dynamics. The capped supply is also favourable for value retention, assuming demand grows as the network develops.

Overall Score - Financials and Metrics

Roadmap

In the most recent published Medium article, the Picasso team highlights that they are preparing to enable IBC connections to the Ethereum and Solana ecosystems, two pivotal events that could transform the existing interoperability landscape.

The team is confident that once connected, there will be significantly greater utility and value to the $PICA token as it is the underlying token powering the ecosystem.

The article also highlights two new partnerships, namely with:

DAO5: an experimental cryptocurrency investment fund with the primary goal of empowering its portfolio founders to co-manage a treasury of strategic assets. It will be converted into a DAO in future. Notable advisors include Emin Gün Sirer (Founder and CEO of AVA Labs) and Meltem Demirors (CSO of CoinShares).

Santiago Santos: Santiago R. Santos is a prominent figure in both traditional finance and the cryptocurrency sector, known for his extensive experience in investments and strategic roles in various investment firms. He also co-hosts The Empire Podcast alongside Blockworks founder Jason Yanowitz, further contributing to his influential presence in the space.

It is also mentioned in the team’s Medium Post: Year in Review that they will be gearing up for the launch of MANTIS - Multichain Agnostic Normalised Trust-minimized Intent Settlement, an ecosystem-agnostic framework designed for intent settlement across chains.

Beyond this, however, the team does not provide further details or plans after the enabling of IBC connections to the Ethereum and Solana ecosystem. Much of the future success of the $PICA token will hinge on the successful integration and IBC connection with the Ethereum and Solana ecosystem, and perhaps with other blockchains thereafter as well.

Overall, while the Picasso team's roadmap exhibits ambitious and strategic expansion plans, along with noteworthy partnerships, it also faces challenges in terms of execution complexity and dependency on external ecosystems.

Overall Score - Roadmap

Supply Tokenomics

In Supply Tokenomics, we analyse what affects the supply of $PICA tokens, such as the allocations to teams and insiders (advisors, VCs etc), as well as the locking and vesting schedules.

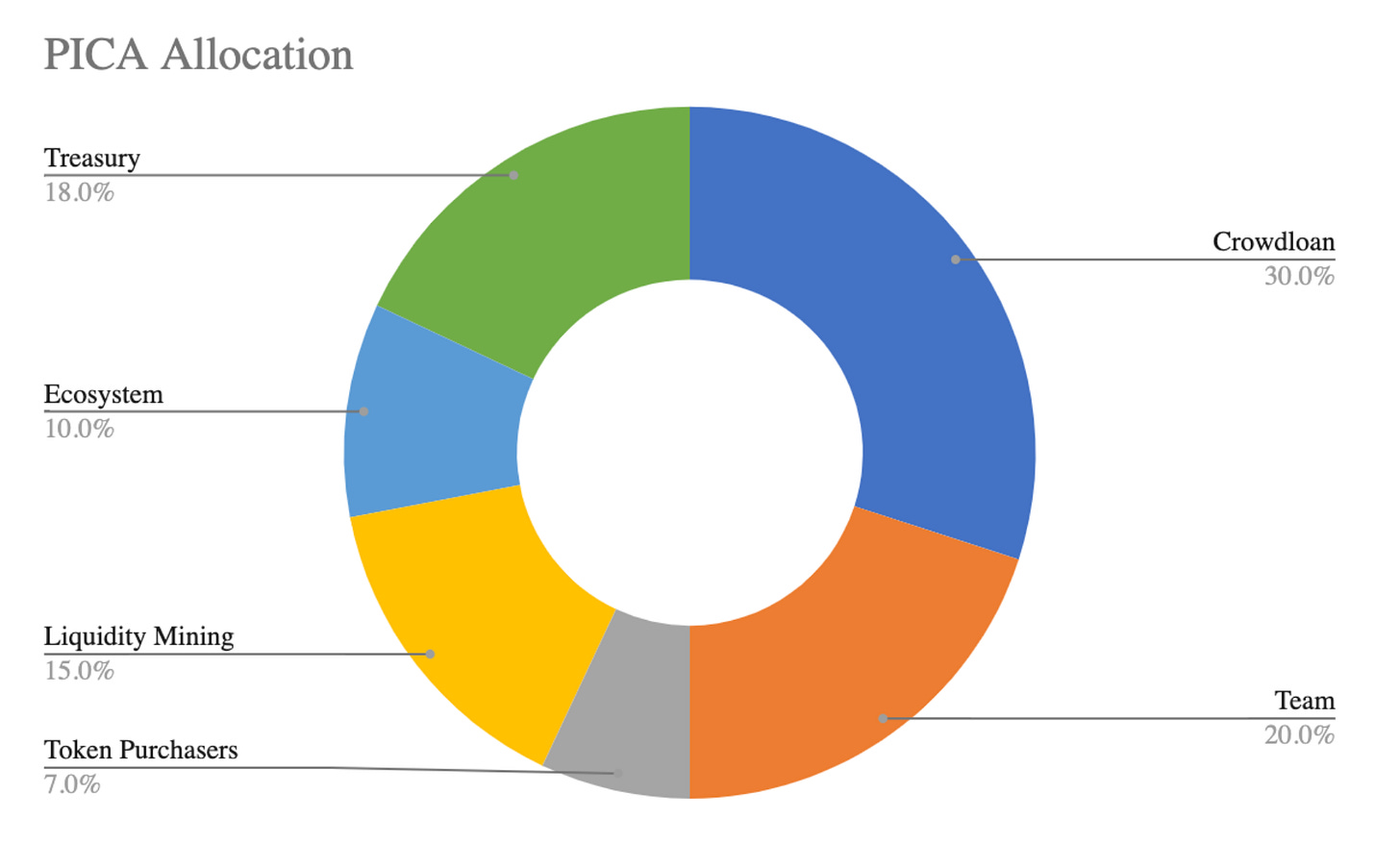

The breakdown of tokens are as follows:

Relatively high max supply of 10B with no token inflation

Founders and Team: 13.65% allocated to founders, early team members, and current contributors, with a 2-year vesting schedule and a 6-month lock.

Key Partners & Advisors: 6.35% with similar vesting term (2-year vesting schedule and a 6-month lock)

Treasury: Approximately 18% for long-term sustainability, governed by the Picasso General Council and later by PICA token holders. 2% is reserved for future personnel incentives, and will be subject to a 4-year vesting schedule from network launch or grant date with a 1-year cliff.

Crowdloan: 30% allocated to crowdloan stakers for parachain lease slots. Crowdloan stakers received 50% upon TGE (Token Genesis Event), and the remainder will be released linearly within 48 weeks (approximately 1 year).

Ecosystem Incentives: 10% for protocol rewards and incentives. These are programmatic incentives to bootstrap network growth such as running an oracle on Apollo.

Series A Token Purchasers: 7% with a 3-month lock-up and 2-year vesting

Liquidity Programs: 15% for liquidity program participants on Picasso.

Token Distribution

Currently, over 50% of tokens have been distributed (see graph below), with crowdloan stakers fully receiving all of their allocated $PICA (30% of total supply) by now.

Based on the token distribution schedule, it is projected that approximately 70% of the total supply will be distributed by July 2024, increasing to about 80% by Jan 2025 next year.

One important point to note is that the high token supply of 10 billion PICA tokens might limit the potential for significant individual token value appreciation. Conversely, this larger supply also helps to keep the current token price lower, potentially making it more attractive and accessible to new investors, which could, in turn, stimulate demand for the tokens.

The distribution schedule supports gradual market absorption, with modest selling pressure from vested tokens belonging to the team, Series A purchasers, and liquidity mining recipients.

Overall, the tokenomics allocation for PICA appears fairly robust with a balanced approach towards long-term stability and immediate ecosystem growth. There are sufficient incentives for insiders (founders, teams, and partners) and for broader community engagement and network development.

Overall Score - Supply Tokenomics

Demand Tokenomics

In Demand Tokenomics, we analyse what affects the demand for $PICA tokens - the more positive factors that increase demand, the greater the potential price in future.

There are multiple use-cases for $PICA, ranging from staking and receiving yield, to being the gas token for CosmWasm dApps deployed on Picasso, to being the primary pairing on the Pablo DEX, and lastly to governance in Picasso’s OpenGov.

For staking and receiving yield, there are several avenues that can be utilized to earn yield in $PICA, namely:

Collator Staking on Picasso: 25% of fees on Picasso are distributed to collators, with the remaining 75% going directly to the community-governed treasury. Collators on Picasso are required to put down a stake to produce blocks on our parachain, as with most proof of stake networks.

Apollo Staking: Apollo is a permissionless, MEV-resistant oracle solution. Anyone can run an oracle node on Picasso by providing a PICA stake.

Validator Staking: PICA is also used to secure the Composable Cosmos chain. This is the first instance of a token being utilized for validation within both the Kusama and Cosmos ecosystems and highlights the critical role PICA plays within cross-ecosystem communication. The Delegation Program sources 1bn $PICA tokens (10% of max supply) from the Picasso Treasury to validators to ensure a robust and secure network while providing a ~10% APR in PICA. Take note that there is a 21-day “unbonding” period after unstaking from a validator before you receive your PICA tokens back.

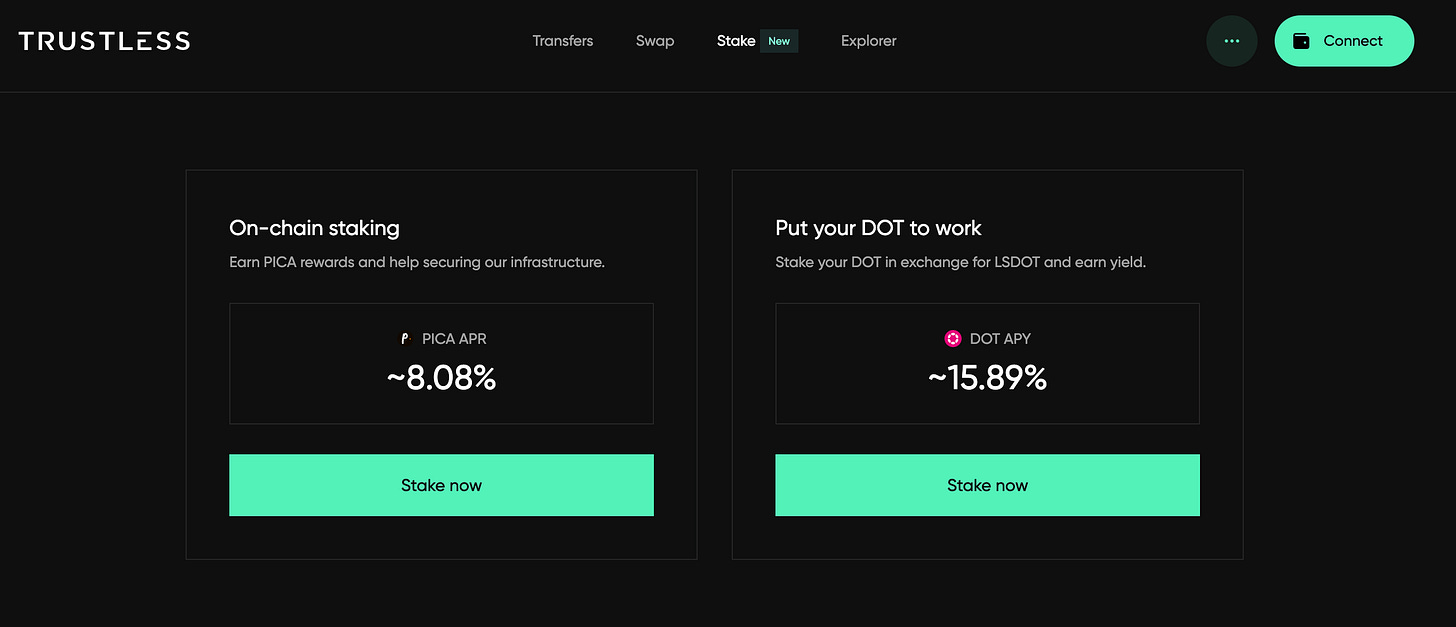

Liquid Staking: Liquid Staked DOT (lsDOT) is Composable's solution to the liquidity challenges in traditional staking within the Polkadot ecosystem. Recently released on 5 Jan 2024, lsDOT offers holders the ability to maintain staking benefits while still having access to liquidity. Any subsequent revenue will flow to $PICA, providing yield emissions from liquid staking, but only while stakings are locked. This initiative enhances utility and flexibility, not just in Polkadot but across various ecosystems via Picasso and the Composable Restaking Layer.

Users can stake DOT on trustless.zone for a current APY of ~15.89%, and can subsequently supply it as liquidity in a lsDOT/DOT pool on Pablo for additional pool incentives.

Future plans include using lsDOT for securing Composable’s ecosystem and expanding its utility across different networks.Bridge Revenue Share: Users would also be able to stake $PICA tokens on trustless.zone and earn a proportional share of revenue generated through cross-ecosystem transfers. The current APY is ~8.08% as shown above.

A tiered reward system will benefit long-term stakers, with those staking for 90 days or more receiving a larger portion of the 20% bridge revenue allocated to PICA stakers.

Currently, Composable ranks 15th in IBC volume over the past 30 days, with significant transaction volumes. The anticipated expansion of IBC to Solana and Ethereum could further boost activity on Composable Finance.Governance: Recently in early December 2023, Picasso entered its OpenGov Phase2, where $PICA token holders are empowered to determine core decisions through on-chain voting.

Holders can propose various initiatives, from technical enhancements to marketing and community growth strategies. Proposals require a 'Decision Deposit,' varying by governance track, to demonstrate the proposer's commitment.Any holder with enough tokens for this deposit can suggest a referendum. Prior to formal submission, it is advised by the team to discuss the proposal on the dedicated governance forum for five days, fostering community engagement and feedback.

Overall Score - Demand Tokenomics

Influencers

From a casual look at the people who mention $PICA or Composable Finance on Crypto twitter, it appears that most tweets originate from individuals in the Cosmos ecosystem.

Some of the more notable influencers I’ve come across that is bullish on $PICA would be CosmosHOSS with 54.6k followers, and Cryptocito with 94.9k followers on Twitter and 44.9k subscribers on YouTube.

However, it also seems that $PICA and Composable Finance have limited reach among the main Ethereum and Solana crypto communities. It will be worth observing the impact of the Solana restaking initiative via Picasso, and if the team is able to capture the attention of Solana DeFi users.

Overall Score - Influencers

Final Thoughts

Picasso and Composable Finance present themselves as robust entities with years of operation and the ambitious aspiration to become the IBC Hub that connects all chains seamlessly - a goal that if successful could potentially transform the way that users interact with crypto by lowering the barriers to entry to connected blockchains.

Overall, the business model, financials, and tokenomics of Picasso and the $PICA token suggest a well-conceived strategic approach to their implementation. However, the Founder, Omar Zaki, is associated with controversies that cast a shadow over the project. Additionally, the issue of unclaimed tokens being revoked from inactive crowdloan contributors through a governance proposal without adequate notice raises concerns about ethical and community relations.

The team's handling of these sensitive issues will be critical in determining the project's reputation and future. A fair and positive resolution to the governance matter would reflect the team's commitment to its community, which is essential for long-term trust and success.

From a broader perspective, if the next few years see a bull-run and heightened general interest in crypto, Picasso and the $PICA token could find themselves in a highly advantageous position. As a central access point for new entrants to navigate through major networks like Ethereum, Solana, and Cosmos, Picasso could capture a significant market opportunity.

Future Flags to Keep Track Of

We have noted a quick list of green flags (positive indicators) and red flags (negative indicators) as a quick heuristic to gauge how well the project will do in future.

The more green flags observed in the future, the more bullish you can be for the project, and vice versa.

Green Flags (Positive Indicators) to keep track of:

Successful IBC connection with Ethereum (mainnet) and Solana

Mentions of the project by key influencers who normally focus on other chains (Ethereum/Solana etc)

Active governance participation from $PICA holders in governance decisions that would suggest a committed and active community.

Positive resolution of governance proposal to extend the claim period of $PICA tokens

Red Flags (Negative Indicators) to watch out for:

Any financial imprudences or team conflicts which would further reinforce the negative controversies that happened in the past

Any negative community sentiment in the governance forums or social media channels such as Twitter and Discord

Poor governance outcomes which may indicate centralization of decision-making power, or low participation in the governance process which might suggest a disengaged community

Any delays to the roadmap execution, in particular the IBC connections with Ethereum (mainnet) and Solana

Support My Research

I hope you've enjoyed this read!

Thank you for taking the time to delve into this deep dive on Picasso and Composable FInance. It's my aim to provide insights that are both insightful and valuable.

If you've found this analysis helpful, I would be truly grateful if you could subscribe to my newsletter and follow me on Twitter/X for more such updates and insights. Your support is incredibly motivating and helps me continue this work!

I strive for accuracy and thoroughness in my analyses. If you notice any discrepancies or areas that require correction, please don't hesitate to contact me. Your feedback is crucial for maintaining the quality and reliability of my work.

Lastly, I'd love to hear your thoughts on this analysis.

Do you agree with my insights?

Are there aspects you think could be further explored or improved?

Please share your perspectives in the comments section below. Your input is not only appreciated but also instrumental in shaping future content.

Once again, thanks for your support and for engaging with my work.