0xBlockBard - OLAS Network Deep Dive Research Report

The Most Comprehensive Fundamental Analysis of the OLAS Network

In this report, we adopt a structured step-by-step approach starting from the overview of the project, its team and roadmap, before diving deeper into the financials and tokenomics.

We also try to break down difficult concepts or technical jargon into simple and more easily understandable points that would help you in making a more astute investment decision, and ideally, saving you tens of hours in the process of doing your due diligence.

This report strives to maintain an impartial and balanced yet critical perspective. Some might perceive our analysis as conservative or skeptical, however, this cautious stance is intentional, considering the prevalence of fraud, scams, and rug-pulls in the cryptocurrency space. We believe it's better to err on the side of caution.

Given the dynamic and often volatile nature of the cryptocurrency market, it's also important to acknowledge that unforeseen developments or emergent information could significantly impact the relevance of some findings here.

Disclaimer

This report is an independent analysis and has not been sponsored or endorsed by any third party. The information provided herein is for informational purposes only and should not be construed as financial, investment, or professional advice.

The cryptocurrency market is highly volatile and unpredictable; therefore, readers are strongly encouraged to conduct their own research and due diligence, and to consult with a qualified financial advisor before making any investment decisions.

The views and opinions expressed in this report are those of the authors and do not necessarily reflect the official policy or position of any agency or company.

As of the date of publication, the authors and contributors to this report declare that they do not hold any positions in $OLAS tokens or any other cryptocurrencies discussed in this report. However, holdings are subject to change at any time without notice.

The authors and contributors bear no responsibility for any financial losses or damages resulting from the use of information contained within this report.

Outline of Analysis

For our analysis of the OLAS Network, we would cover the following topics below in order:

Bear in mind that these scores are purely subjective, and it’s perfectly fine for another person to have contrasting thoughts and opinions. I have also refrained from tallying up all the scores as it is more important to understand each element on its own instead of an aggregate total, which might not accurately reflect the individual significance of each component.

Project

Important Terms

Before we begin proper, there are several important entities and terms within this ecosystem that would be helpful to first understand:

1. The Autonolas Protocol: A collection of smart contracts that implements a mechanism to coordinate, secure, and manage software code on a public blockchain (currently Ethereum, Polygon, Gnosis Chain, and Solana), and provides incentives to developers proportional to their contribution to the growth of the protocol. The main website is https://autonolas.network. The Autonolas Protocol may also be referred to as the OLAS Protocol.

2. The Autonolas DAO: The Autonolas DAO is made up of holders of veOLAS (locked OLAS), and governs or steers the Autonolas Protocol, and is also referred to as the OLAS Network. The DAO governance’s authority includes whitelisting of LP tokens for bonding, changing of parameters in the smart contracts, and allocation of grants from the Autonolas Treasury among others. The main website is https://olas.network and is distinct from the protocol’s website above.

3. $OLAS Token: The token follows the ERC-20 standard and is deployed on the Ethereum mainnet. It has an inflationary token model to account for bonding incentives and Olas component/agent top-ups (which can essentially be understood as developer incentives to build on Autonolas).

4. Bonding: The bonding mechanism is an important part of Autonolas Tokenomics and is modelled after Olympus DAO v1 with some differences. The concept of bonding is basically for users to acquire a protocol’s tokens at a discount by providing liquidity. This supports the project with a deeper liquidity pool, while supporters are able to acquire tokens at a cheaper price.

On top of the bonding mechanism, the Autonolas team implemented a control mechanism to ensure that the growth of protocol-owned liquidity is proportional to the growth of components/agents’ usefulness. This control mechanism is enforced by several built-in on-chain metrics which are used to estimate the potential for the production of code.

Overview

The Autonolas DAO, also known as the OLAS Network, is designed to foster the development and operation of autonomous applications.

These autonomous applications are primarily off-chain but secured on-chain, and are characterised by their ability to run continuously, act independently, interact with the world beyond blockchains, execute complex logic, are composable and crypto-native (decentralized, trust-minimised, transparent and robust).

The OLAS Network is built on their autonomous agent technology, namely the Open Autonomy Framework, which is a framework for the creation of agent services - “off-chain autonomous services which run as a Multi-Agent-System (MAS) and offer enhanced functionalities on-chain”.

Agent services can execute arbitrary operations in a decentralised way, are trust-minimised, transparent, and robust. Agent services remove the need of strong trust assumptions that traditional centralized off-chain services require.

Within their documentation, the OLAS Network highlights several potential use-cases for agent services that could be implemented in future:

Internal DAO Operations:

Meta Yield Hunter: Use machine learning to track yield opportunities across chains and protocols. Autonomously move positions to optimize yield.

Asset Whitelisting: Dynamically evaluates assets based on diverse datasets to add and remove from whitelists.

Contribution Coordinator: Watch for contributions on GitHub, Twitter etc and adjust on-chain rewards & permissions accordingly.

Miscellaneous Services:

Web3-native Recommender: Build the first co-owned and operated engines to track opportunities and make personalized recommendations to crypto users.

NFT Collector: Allow users to passively build exposure to quality baskets of NFTs.

Fund Manager: Overcome the legal and trust challenges of running a decentralized fund.

Customisable app infrastructure:

Oracles (On-chain Data Reporter): Build future-proof oracles that are totally customisable, without permission, and owned by you.

Keepers: Build robust keeper systems that you can extend to maintain any on-chain data, based on a rich set of criteria which you define

Bridges (Cross-chain Messenger): Spin up your own bridges to sync any type of data across chains and infrastructure. Combine with your oracles and keepers to build rich new services.

The OLAS Network aims to transform linear component, agent, and service growth into exponential application opportunities, going beyond traditional software framework architectures by allowing developers to encapsulate business logic into software components.

This approach positions the OLAS Network as a significant player in the field of autonomous applications, particularly within the crypto space.

Protocol Business Model

The Autonolas Protocol's business model aims to reward capital and code contributions through the issuance of newly-minted OLAS tokens. The protocol anticipates generating profits to fund ecosystem initiatives, such as grants, from three main sources:

Autonolas Protocol-owned Services (PoSe): The protocol governs services that generate profits, which are then donated back to the protocol. A portion of these donations, excluding those returned to component/agent developers, are retained by the treasury.

Protocol-owned Liquidity (PoL): This includes funds deployed to third-party protocols for activities like providing liquidity in decentralized exchanges or invested in Protocol-owned Services. All profits from PoL activities are owned by the treasury.

Third-party Services: A smaller portion of the protocol's profits is expected to come from the treasury's share of voluntary donations from third-party services.

The key to the success of the OLAS Network hinges on the creation of numerous agent services that add substantial value. A significant advantage of this model is the minimal maintenance costs associated with software or code.

Additionally, the network benefits from low marginal costs coupled with the potential for exponential returns, especially when these services are implemented across a diverse range of decentralized applications (dApps) and blockchains.

Overall Score - Project

Team

Founding Team of the DAO

From the OLAS Network FAQ, it is stated that the OLAS DAO was founded in 2022 with ~50 participants, and all the founding members paid their share of the costs (in total it was in the order of tens of thousands of dollars. However at present, not much is known about who these 50 participants are. This is important information as 32.65% of OLAS tokens are distributed to founding members of the DAO.

We also know that the launch of Autonolas DAO was led by Valory AG (which itself was formed around mid-2021) with the help of $4 million in seed funding around mid-October 2022.

The funding round was led by True Ventures with participation from Signature Ventures, Semantic Ventures, Prime Block Ventures, Proof Group, and Atka.

It is unclear if these VC groups have any share of the OLAS tokens distribution at the moment.

Valory AG

Based in Zug, Switzerland, the Valory team describes themselves as a team of scientists, engineers, and creatives who seek to deliver world architecture autonomy development at multi-agent services. The company was founded by David Minarsch (CEO) and David Galindo (CTO).

David Minarsch (CEO) has a background in leading the team which built the first framework for developing Multi-Agent Services (MAS) in the Distributed Ledger Technology (DLT) space. He has prior experience via Entrepreneur First and a PhD in Applied Game Theory from the University of Cambridge.

From the Valory website as well, David Galindo (CTO) previously served as an Associate Professor of Computer Security at the University of Birmingham, and is a renowned scientist in the field of cryptography with over 15 years of experience in computer security.

Both co-founders have strong and robust LinkedIn profiles with over 500 followers each, which supports their credibility and stated backgrounds on the Valory website.

The Valory website also lists Oaksprout The Tan as another co-founder (CPO), with his name likely a pseudonym. He is described to have made significant contributions to a number of crypto-network communities by developing well-used ecosystem tools, education sites, and community building efforts.

There are a total of 16 people in the Valory team (including the three co-founders), with a good mix of roles between smart contract development, frontend, cryptography, operations, and community management.

There are also no Glassdoor reviews or Google reviews of the Valory AG company at present. No advisors of the team have been listed.

Overall Score - Team

Financials and Metrics

Here we’ll take a closer look at the metrics and financials of the $OLAS token (for clarification, text in blue are added/calculated by us based on the underlying source data):

Note: Data is correct as of Wednesday, 13 December, 2023, 09:00 ET

What do the numbers mean?

Firstly, we note that coingecko and coinmarketcap both seem to use the total supply metric of 536m tokens. However, in keeping to the definition of Fully Diluted Valuation which should be based on the theoretical maximum total supply of tokens, we used the max total supply of tokens as stated in the whitepaper (it is capped at 1B for the first 10 years and 2% maximum total inflation per annum thereafter, subjected to change from governance). For simplicity sake, we use the value of 1B for the calculation of our FDV value.

At first glance, the market cap to FDV ratio is pretty low at 0.052 (i.e. market cap is ~5.2% of FDV), indicating that while there is room for the project to grow, there is still a considerable amount of tokens not in circulation.

Once these tokens enter the market (depending on their vesting/unlocking schedules which we will investigate further below), they could potentially dilute the value or imply significant growth potential of the token.

Fully Diluted Valuation (FDV) is the theoretical market cap of a coin if its max supply is in circulation, and is calculated at current price x total max supply. This gives investors a view of what the total value of the project could be if the market conditions remain constant and all the tokens are released.

24hr Trading Volume

There is currently healthy trading volume of the $OLAS tokens, at approximately 2% of the market cap. This indicates a liquid market and active trading interest (though for our investment, we have to consider if this is mostly from recent hype and speculation, and if the trading volume will dip down after some time).

Circulating Supply

At present, more than half of the $OLAS tokens (i.e. 53.6% - calculated from total supply / max supply) have been released into the market in some form, although the circulating supply is significantly lower at 9.66% of total supply (536m), and 5.2% of theoretical max supply (1B).

The lower the circulating supply relative to total supply, the more susceptible it could be to price shocks from an influx of supply (e.g. tokens vested/unlocked).

veOLAS (locked $OLAS)

On the other hand, some promising signs are that the percentage of locked $OLAS (veOLAS) is significantly high at 34.83%, which represents that a large majority of token holders believe in the project.

Token contract for veOLAS: https://etherscan.io/token/0x7e01a500805f8a52fad229b3015ad130a332b7b3

DAO Treasury

Also, the tokens allocated to the DAO Treasury at 100m (18.63%) seem to be untouched at present, and is most likely set aside to fund future development projects or ecosystem grants.

Team

For the tokens allocated to the Valory team (at 19.51%), while it is fairly significant we can also argue that it represents a healthy stake and financial incentive for them to lead the Autonolas ecosystem and OLAS Network to success.

buOLAS (burnable $OLAS)

Burnable OLAS (buOLAS) are tokens connected to team vesting for the founding DAO members; the majority of which is set to unlock in mid-to-late 2026. It is also governed by the DAO holders of veOLAS who can decide to burn tokens of team members who are deemed as no longer contributing.

Token contract for buOLAS: https://etherscan.io/token/0xb09ccf0dbf0c178806aaee28956c74bd66d21f73

Adjustments

One point to note is that the present circulating supply percentage and locked percentage would be higher if we adjust for the total supply by removing from calculation the buOLAS tokens (which are locked and vested over time until 2026), DAO Treasury tokens, and locked Valory team tokens.

After removing the locked tokens from the calculation, we see that the locked $OLAS (veOLAS) percentage and estimated circulating supply percentage are healthier at 69% and 19% respectively.

One caveat to consider is that veOLAS may be locked in weeks, up to a maximum of 4 years (we will cover the distribution of the unlocking schedule in the Supply Tokenomics section below). This would be important for you to consider as it would add to increased selling pressure at the times when significant number of tokens are unlocked.

Protocol Metrics

On the relevant protocol metrics side, we use the number of services, agents, and components as an indicator of developer activity on the protocol - which fundamentally is one of the most important metrics since it represents a direct use-case (and usefulness) of the OLAS Network.

Another important metric to consider would be the revenue created by the various autonomous services for the protocol - in the whitepaper, this is described as “donations” which may arise from Autonolas PoSes (services owned/managed by the Autonolas DAO, and third-party PoSes - managed by third-party DAOs).

Based on data from Dune, the total donations received by services is at 12.65 ETH (or $28421 USD at 11 Dec Price - $2,246 USD to 1 ETH), which does not seem to be very impressive at the moment relative to their market cap.

A positive perspective to have would be that this is still in the very early stages, and the number of services, agents, and components are still increasing.

With more services, agents, and components over time, the total amount of donations is expected to increase.

However, one caveat is that either the total number of services/agents or the usefulness/value-add of present/ services/agents would have to increase almost exponentially to represent a more healthy proportion of the protocol’s market cap.

Overall Score - Financials and Metrics

Builders

Referencing the OLAS Network registry, there are a total of 165 components, 24 agents, and 20 services on the Ethereum mainnet.

Taking a closer look at these services include “a set of agents implementing the El Collectooorr” (Service ID 1)

and “a set of agents implementing the Autonomous Fund” (Service ID 2).

However, it is not immediately apparent what these services do (and similarly for components and agents), or how they contribute to the wider ecosystem. It will be useful if there is more information for each of these various parts that is structured and neatly organised.

Autonolas Academy

The Autonolas Protocol also has a cohort-based training program called the Autonolas Academy which teaches developers how to build and run autonomous services. It runs for 4 weeks with a time commitment of 2hours per week for coaching sessions and time to build.

Thus far, there are a total of 4 cohorts, with the first cohort having graduated on 16 Feb 2022, and one ongoing cohort.

Across the four cohorts, there were 17 participants, but seven did not finish the academy training program, a figure that might initially appear underwhelming.

However, the low turnout could be due to the requirement of specific technical skills and knowledge and the availability of open video recordings of past cohorts

Website Documentation and Guides

Overall, the documentation and guides on how to get started building on Autonolas using the Open Autonomy Framework are fairly robust and well-organised.

However, the barrier to entry for new developers remains high due to the steep learning curve and complexity involved for developers in learning how to set up agent services of their own.

Much of the future success of the Autonolas Protocol, OLAS Network, and corresponding $OLAS Token will depend on how many new developers the team will attract and how many new value-adding agent services will be created.

Added (18 Dec): Increased score from 6/10 to 7/10

Notably, many projects using the Autonolas stack for autonomous agent services have emerged as winners in various hackathons.

Highlights include:

Faucetation Station: a community-owned, bot-resistant faucet service for blockchain developers, which was the winner of “Filecoin & IPFS - Best Use” and the “Scroll - Pool Prize” awards in ETH Online 2023

Collateralisation Station: A solution offering trustless liquidity for autonomous agent service NFTs, securing second place in the “1Inch Network - Open Track” and “Neon EVM - Best Neon EVM use case 4th place” awards at ETHGlobal Istanbul 2023

Decentr-API: An autonomous decentralized load balancing for web3 transactions, which grabbed the Skale Grand Prize and several other awards, including “Skale - Partner Integration”, “Skale - Pool Prize”, and “Gnosis Safe — Best Novel Implementation of a Safe” at ETH Amsterdam 2022.

Plantation Station: A decentralized agent service that monitors, manages and optimizes the yield of plants and vegetables, awarded the “Sustainability & Urbanism Award” and three additional prizes at ETH Prague 2023.

Seeing many developers use the Autonolas stack for projects and win hackathons is a promising sign. It shows that the tech stack is useful, and this will lead to an increasing number of builders utilising it. These wins at hackathons are a great signal that autonomous agent services have real solutions for real problems.

Credit to 8Baller who shared these projects with me in the discord server

Overall Score - Builders

Roadmap

The OLAS Network has two proposals currently in their roadmap, namely:

Build-A-PoSe: Proposed on October 13, 2023 and currently WIP (Work-in-progress), this proposal suggests implementing a structured programme operated by the DAO to consistently deliver new OLAS-owned services.

Build-A-PoSe will utilise the existing protocol-owned services (PoSe) and dev rewards mechanism built into the Autonolas Protocol, to 1) coordinate developers in the OLAS DAO to build components for new PoSes, and 2) to coordinate OLAS DAO members to shepherd the development and distribution of new PoSes.Triple Lock: Proposed on August 15, 2023 and currently approved, this proposal suggests making an upgrade to the protocol that improves bonding, dev rewards, and staking. Triple Lock will create and reinforce token sinks for the $OLAS token.

Furthermore, the proposal suggests a bonding strategy whereby the DAO creates bonding products for LP assets which pair $OLAS with the native token for each chain on which the Autonolas Protocol is deployed.

The latest proposal Build-A-Pose aims to tackle the above-mentioned problems of attracting new developers into the ecosystem and increase the number of agents and services built on the protocol, which is a step in the right direction

However, more information on the Valory team’s direction for the Autonolas Protocol and DAO does not seem readily available. There also seems to be no information on how the Treasury DAO tokens are intended to be used, which could be a powerful incentive to provide grants and funding to attract new developers.

Although not yet officially verified, the list of repositories in the Valory GitHub includes one that suggests the development of contracts on Solana (refer to Appendix B). This indication, if substantiated, could positively influence the overall protocol and price movement.

On getting the $OLAS token listed on a CEX, the team has said (in discord) there is no imminent plans, and the DAO’s focus is on the decentralised approach of growing liquidity via bonding.

Added (18 Dec): Increased score from 6/10 to 6.5/10

The team is also implementing a step-by-step structured plan, referred to as OLAS Staker Expeditions, to introduce staking to the OLAS Network. This plan is divided into three phases, each designed to progressively roll out and refine the staking mechanism, ultimately adding more utility and demand for the $OLAS token

.

Currently in its initial phase, Phase 1: Everest, the pilot stage is limited to just 10 slots, reserved for the most active members of the community. This limited launch allows for focused testing and feedback.

The next phase, Alpine, will broaden participation to 50 slots. This expansion aims to further shape and improve the staking process, including the rewards mechanism, based on the insights gathered from the first phase.

The last phase, Coastal, will open up 100 slots for participants. This final phase is intended as the concluding round of testing and fine-tuning, setting the stage for the full public release of the staking feature to all OLAS users.

Overall Score - Roadmap

Supply Tokenomics

In Supply Tokenomics, we analyse what affects the supply of $OLAS tokens, such as the allocations to teams and insiders (advisors, VCs etc), as well as the locking and vesting schedules.

OLAS Tokenomics are inflationary and is designed to attract more capital and developers into a virtuous flywheel, in turn increasing the number of autonomous applications.

The breakdown of tokens are as follows:

max supply of 1B for the first ten years, and 2% token inflation per annum thereafter

32.65% distributed to founding members of the OLAS DAO

10% distributed to Valory AG to maintain, run, and further the Autonolas Protocol

10% distributed to the Autonolas DAO Treasury (which seem to be untouched at the moment as referenced in our Financials section)

47.35% to incentivize developers’ top-ups for useful code and bonders, autonomously provisioned by the protocol over the initial ten years

The protocol aims for an S-shaped curve of token emissions:

The allocation of tokens in this project is notably divided, with a substantial 42.65% designated for insiders (team and founding members), and a nearly equal 47.35% earmarked for developer incentives and bonders (public).

The proportion allocated to the founding team members and investors can be seen as reasonable, depending on one's viewpoint, especially considering their initial financial contribution to kickstart the project.

Currently, in our Financials section, the key metrics to focus on are the 186 million locked tokens (veOLAS) and the team burnable buOLAS tokens.

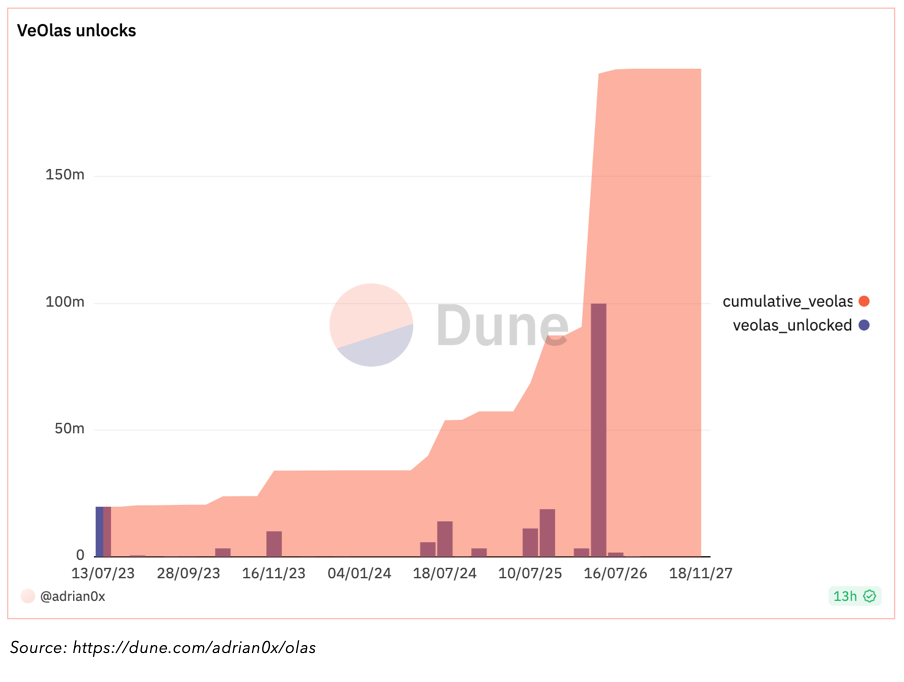

Unlocking schedule of veOLAS (locked OLAS)

There is a gradual increase in unlocked veOLAS over time. The most significant times when a large number of veOLAS will be unlocked is

11th and 18th July 2024

10th and 17th July 2025

9th July 2026 (largest spike)

Unlocking schedule of buOLAS

For team members buOLAS, the unlocking schedule is fairly regular, occurring at the same time period every year. The most substantial releases for buOLAS are slated for:

14th and 15th July 2024

14th and 15th July 2025

14th and 15th July 2026

Around these specific periods, particularly in July of each year, there is a possibility of increased market liquidity of $OLAS tokens, potentially leading to heightened selling activity.

Overall, this unlocking schedules for veOLAS and buOLAS is a good indicator for investors as most of the tokens are locked for an extended duration, which signifies a longer-term commitment from stakeholders to the project’s success and correspondingly, lower selling pressure on $OLAS tokens.

Overall Score - Supply Tokenomics

Demand Tokenomics

In Demand Tokenomics, we analyse what affects the demand for $OLAS tokens - the more positive factors that increase demand, the greater the potential price in future.

On its own, the $OLAS token does not have any direct benefits for investors . It basically has two main purposes: i) locking it for veOLAS and ii) using it to acquire LP-tokens to participate in the bonding mechanism to obtain OLAS at a discount.

While this benefits the protocol by making it more robust with additional liquidity, investors will face increased opportunity costs as they have to lock their funds in the project instead of being able to deploy it elsewhere.

After locking the $OLAS token for veOLAS, investors will be able to participate in the Autonolas DAO governance and influence the protocol and its tokenomics. In future, veOLAS holders will be able to participate in protocol governance off-chain and form subDAOs to enrich on-chain contribution metrics.

There are also no indications at present on whether the DAO may consider using revenue to buy back tokens, albeit this could be submitted as a governance proposal in the future.

Overall, the demand tokenomics of the $OLAS token are designed by the team with a long-term perspective, prioritising protocol liquidity robustness, stakeholder alignment, and governance participation over immediate financial returns.

For investors, if you believe that the project will do well in future and wish to be an active member, you can lock the $OLAS token and participate in governance.

On the other hand, if you are more price-sensitive, you may want to consider not locking your tokens and instead, wait for the opportune time to get a decent return from your investments - one caveat being that your emotions will be subject to the volatility of the market.

Added (18 Dec):

With a future addition of an $OLAS staking mechanism, it is likely that there may be increased demand for $OLAS tokens in the lead-up to the final rollout. Further details about the specifics of the staking mechanism remain limited at this stage.

However, it's plausible that staking rewards could be in the form of extra $OLAS tokens potentially through minting (which would also impact the supply tokenomics as well). It could also be interesting to consider the prospect of real yield from the fees generated by autonomous agents being distributed to stakeholders in future.

Overall Score - Demand Tokenomics

Influencers

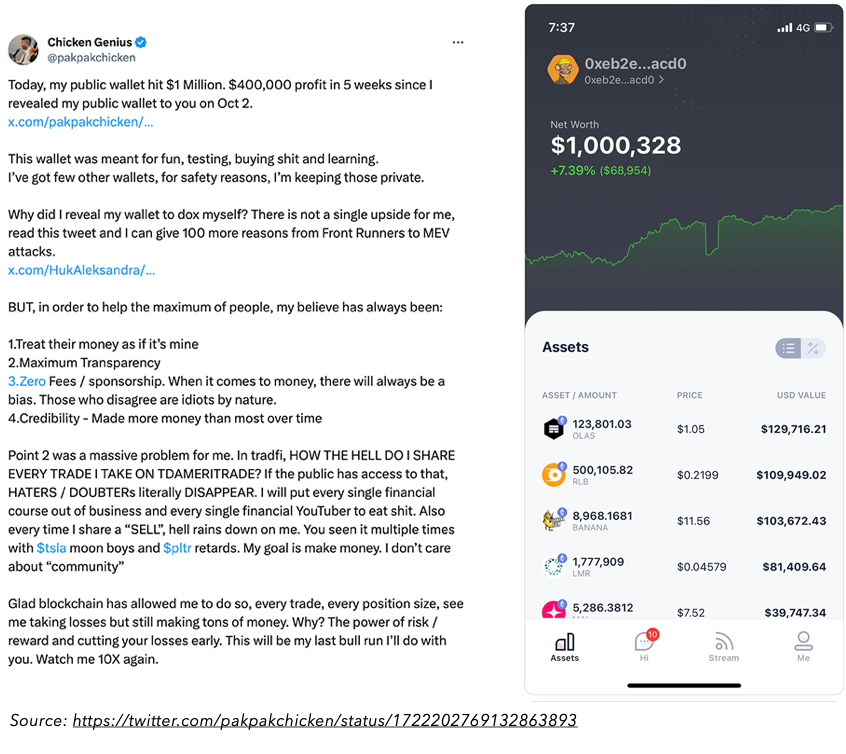

One of the first major influencers to talk about $OLAS would notably be Chicken Genius (@pakpakgenius) in the following tweet below on Nov 8, 2023 where $OLAS was noticeably the top asset with the highest USD value at $129k:

Below are some of his other tweets talking about $OLAS as well:

Dec 5, 2023

Sentiments-wise, we can see Chicken Genius is extremely bullish on $OLAS, however we have to balance it with the fact that he has a huge bag of $OLAS worth $715k USD (after it ~6x from Nov 8) at the time of writing, so there will obviously be some bias present.

Looking at the content of the more recent tweet, on the use-cases of AI agents, we are more conservative and think that while it may be possible in the future to achieve the things he mentioned, the current state of the OLAS DAO still has many things to improve on - such as attracting more developers, building more service agents, and increasing the protocol revenue (or donations as referenced in the whitepaper).

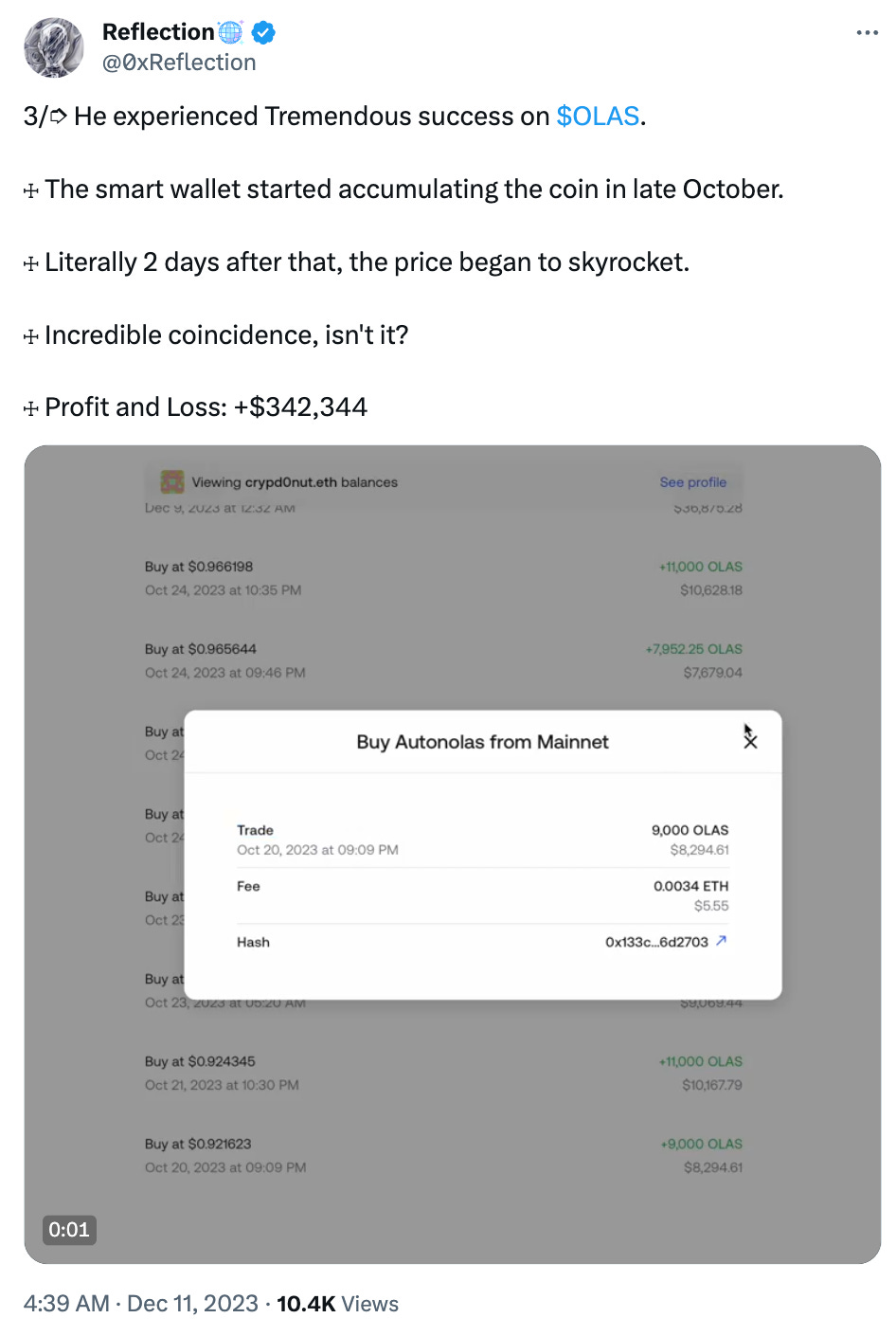

Other notable influencers that have talked about $OLAS include:

0xReflection: https://twitter.com/0xReflection/status/1733964598905364745

and cyrilXbt: https://twitter.com/cyrilXBT/status/1734318852383600905

Overall Score - Influencers

Final Thoughts

The OLAS Network is a robust and well-thought-out project with strong fundamentals and a self-developed framework - the Open Autonomy Framework used to develop multi-agent systems.

Autonomous agents can be game changers in the web3 space due to their ability to integrate off-chain and on-chain in a decentralised, transparent, and almost trustless way.

While the potential returns can be exponential, the team will face the uphill challenge of attracting new developers into the ecosystem and reducing the barriers to adoption by other dApps, developers, and projects.

On token distribution, while the team and insiders have a significant amount allocated to them, most of these tokens will be unlocked and released over several years. The long locking schedule also helps align incentives with the project's success in the long run.

One limitation is that the real demand for $OLAS tokens on their own appears modest, with their primary uses being limited to locking for governance participation or engaging in the bonding mechanism. This creates a dilemma for investors, highlighting the opportunity cost of immobilising liquidity that could potentially be allocated to other projects.

With the anticipated rise of AI-driven narratives within the web3 and cryptocurrency sectors in the next bull run in 2024, the OLAS Network seems strategically positioned to capitalise on the upcoming wave.

Overall, my conviction leans towards the OLAS Network as a worthy investment prospect, given its considerable promise and future potential.

Future Flags to Keep Track Of

We have noted a quick list of green flags (positive indicators) and red flags (negative indicators) as a quick heuristic to gauge how well OLAS Network will do in future.

The more green flags observed in the future, the more bullish you can be for OLAS Network, and vice versa.

Green Flags (Positive Indicators) to keep track of:

Increasing number of services built on OLAS Network

Increasing amount of donations to the OLAS Treasury

More initiatives to onboard developers into the ecosystem

Use of treasury grants to fund more initiatives that grow the ecosystem

More integrations with other blockchains (e.g. Solana) which expand the Autonolas Ecosystem exponentially

Evidence of adoption by established projects or teams can provide validation and support

Red Flags (Negative Indicators) to watch out for:

Stagnant growth in the number of services, amount of donations, and number of developers in the ecosystem

Excessive speculation that may lead to inflated token valuations (resulting in misalignment with the token's intrinsic value, which could result in subsequent market corrections).

Delayed or consistently missed milestones from the roadmap, which may hint at possible operational inefficiencies or execution problems.

Support My Research

I hope you've enjoyed this read!

Thank you for taking the time to delve into this deep dive on the OLAS Network. It's my aim to provide insights that are both insightful and valuable.

If you've found this analysis helpful, I would be truly grateful if you could subscribe to my newsletter and follow me on Twitter/X for more such updates and insights. Your support is incredibly motivating and helps me continue this work!

I strive for accuracy and thoroughness in my analyses. If you notice any discrepancies or areas that require correction, please don't hesitate to contact me. Your feedback is crucial for maintaining the quality and reliability of my work.

Lastly, I'd love to hear your thoughts on this analysis.

Do you agree with my insights?

Are there aspects you think could be further explored or improved?

Please share your perspectives in the comments section below. Your input is not only appreciated but also instrumental in shaping future content.

Once again, thanks for your support and for engaging with my work.

Helpful Links

Autonolas / OLAS Network:

Dune Analytics:

Autonolas Academy - Learn how to set up an agent

hi man, been triyng to message you on X, my account is @0xmariomez, i'm also an indipendet researcher and investor primarly focusing on the web 3 AI stack atm, i was keen to discuss about anything related to the world of crypto and investing, if you are interested of course. let me know if that's the case :)

very well researched in a nicely structured way! congrats