0xBlockBard Alpha Digest #4

Eye of the Storm: Deceptive Lull or Storm's End?

GM and welcome back to the 4th edition of my Alpha Digest!

Important: The content in this newsletter is for informational purposes only. It should not be considered financial or investment advice. Cryptocurrency investments are volatile and high-risk. Only invest what you can afford to lose.

Market Overview

The market has shown some signs of recovery following last week's crash, with whales buying the dip and spot Ethereum ETFs seeing $24.34 million in net inflows yesterday.

Bitcoin has rebounded to $60,887, marking a fairly significant 22% increase from its low of $49,842 just last week. Similarly, Ethereum has climbed to $2,733, a 23% recovery from its low of $2,226.

This recovery, while encouraging, should be viewed with cautious optimism. The market remains highly volatile, with many analysts expecting another dip and price correction before a larger rebound in Q4 as we near the US Elections.

Historically, Bitcoin (and the larger crypto market) tends to rally leading up to and after the US Presidential elections. This also coincides very nicely with the Bitcoin halving (almost like Satoshi planned it…)

However, as the saying goes, past performance is not indicative of future results, and there's always a chance this election could be an exception to the trend.

Therefore, it's crucial to consider this historical pattern alongside other market factors and indicators when making your investment decisions.

Yen Carry Trade: Is the unwinding over?

Not quite yet.

The recent market turmoil stems from the unwinding of the Yen carry trade, est at $450 billion.

According to analysts, only about 50 to 60% of this trade has been unwound so far, leaving significant room to continue.

The unwind so far has mainly involved foreign speculators who borrowed Yen to invest in higher-yielding currencies.

However, Japanese "real money" investors, including pension funds and insurance companies, also have significant exposure through unhedged foreign assets.

These Japanese investors own over $4.1 trillion of foreign stocks and bonds.

If they start to reduce these positions or increase hedging, it could significantly impact global markets.

Thankfully, analysts haven't seen evidence of this happening yet.

Key factors to watch that could indicate further unwinding:

Aggressive Fed rate cuts

If there is a major selloff in US Big Tech stocks

Increased market volatility from other sources

These events could force more de-risking of carry positions and potentially lead to broader market impacts.

As the Yen carry trade unwinds, analysts are eyeing the yuan and Swiss franc as potential new targets for carry trades. State Street and Citigroup analysts suggest the franc could replace the Yen as the go-to currency.

As investors potentially pivot from Yen to Franc or Yuan carry trades, it could trigger a domino effect affecting volatility across multiple currency pairs, leading to increased market uncertainty.

This shift could trigger significant capital flows, impacting global bond yields and equity markets.

Some analysts are concerned about the Yuan carry trade being unwound next (estimated to be greater than $500 billion as of 2022).

However, due to different underlying economic fundamentals, it is less likely to have the same impact as the Yen carry trade unwinding.

Projects I’m Watching

Move aside, Blast L2. The new talk of the market is now Sui, Sei, and Mantle.

While Crypto-AI and Real-World Asset (RWA) topics remain in focus, the former is becoming increasingly saturated.

Here are some projects that have caught my attention, and perhaps may catch yours too.

Haedal Protocol (Liquid Staking on Sui)

Haedal Protocol is a pioneering liquid staking protocol built on the Sui blockchain, designed to enhance liquidity and security within the ecosystem.

It allows users to stake their SUI tokens, contributing to governance and the overall decentralization of the Sui network.

In return, participants receive haSUI tokens, which can be used to generate additional yields in various decentralized finance (DeFi) activities.

This up-and-coming team has already made waves, winning both the Sui x KCLabs Hackathon in July 2023 and the Sui Liquid Staking Hackathon in December 2023.

Currently, Haedal Protocol has a total of $30.92 million in Total Value Locked (TVL) and is experiencing one of the fastest growth rates in the Sui ecosystem, with a 75.63% increase over the past seven days and a 27.74% increase over the past 30 days.

According to CoinMarketCap, the total market cap is estimated to be at $25,043,286, with a fully diluted market cap of $25,107,130.

Delysium (AI)

Delysium is a unique project building a collaboration network for autonomous AI agents, including Lucy and the YKILY (You Know I Love You) AI-Agent Network Layer, which is designed to function in parallel with the Blockchain Layer.

In more human-speak, Delysium aims to integrate many autonomous AI agents with specific roles and functions that can interact with dApps on the user’s behalf for various web3-related tasks.

Think about monitoring token contracts and transaction data, formulating trading strategies, finding the most efficient transaction routes across various on-chain markets, or even specific project and whitepaper analysis work.

The Delysium team has secured $14.02 million in funding to date. Their most significant rounds include a $10 million raise on October 17, 2022, and an undisclosed round of $4 million on March 14, 2022.

Currently, the Delysium token ($AGI) is trading at $0.132, representing approximately an 80% drop from its peak of $0.672 on March 10, 2024.

According to CoinMarketCap, the total market cap is estimated at $123,695,079, with a fully diluted market cap of $407,661,668.

With the recent release of their Lucy Beta and loyalty programs, we’ll see if this sparks renewed interest in Delysium in the crowded crypto-AI space.

Spectre AI

Spectre AI leverages artificial intelligence to provide advanced tools for crypto traders and investors.

The platform uses machine learning algorithms to analyze DeFi projects and historical data, identify patterns, predict cryptocurrency price movements, and generate short-term price forecasts for various timeframes, including 6, 12, 24, and 48 hours.

The Spectre AI Search Engine Closed Beta will be available to selected holders on August 20. For a more in-depth look on its features, check out this walk-through video by Sunny, Founder of Spectre AI.

The team is also looking to build a new product, Spectre DexScan, a reimagined and improved version of Dextools that offers advanced price-action charts, real-time buy and sell indicators, and other enhancements.

Specific funding details for the Spectre AI team remain undisclosed.

Looking at the current market performance, the Spectre token ($SPECTRE) is trading at $1.54, showing a 12.51% increase over the past seven days, but a 3.48% decrease over the past 30 days.

According to CoinMarketCap, the total market cap is estimated to be at $14,048,268, with a fully diluted market cap of $15,447,846.

MANTRA Chain

An up-and-coming RWA protocol, MANTRA Chain, has been capturing many eyeballs recently on Crypto Twitter with their business moves and community initiatives, most recently at Istanbul Blockchain Week.

Season 2 of the 50M $OM GenDrop launched recently on July 17, 2024, with various new missions for participants to complete.

Multiple avenues exist for ecosystem participation and GenDrop eligibility, including contributing to the USDY Chakra Liquidity Pool, completing user KYC, holding specific NFTs such as Pudgy Penguins, and being an active member of the community.

On market performance, the Mantra token ($ OM) is trading at $0.988, showing an 8.33% decrease over the past seven days and a 7.27% decline over the past 30 days.

According to CoinMarketCap, the total market cap is estimated at $827,740,366, with a fully diluted market cap of $879,194,598.

Previous Project Updates

Yaka Finance

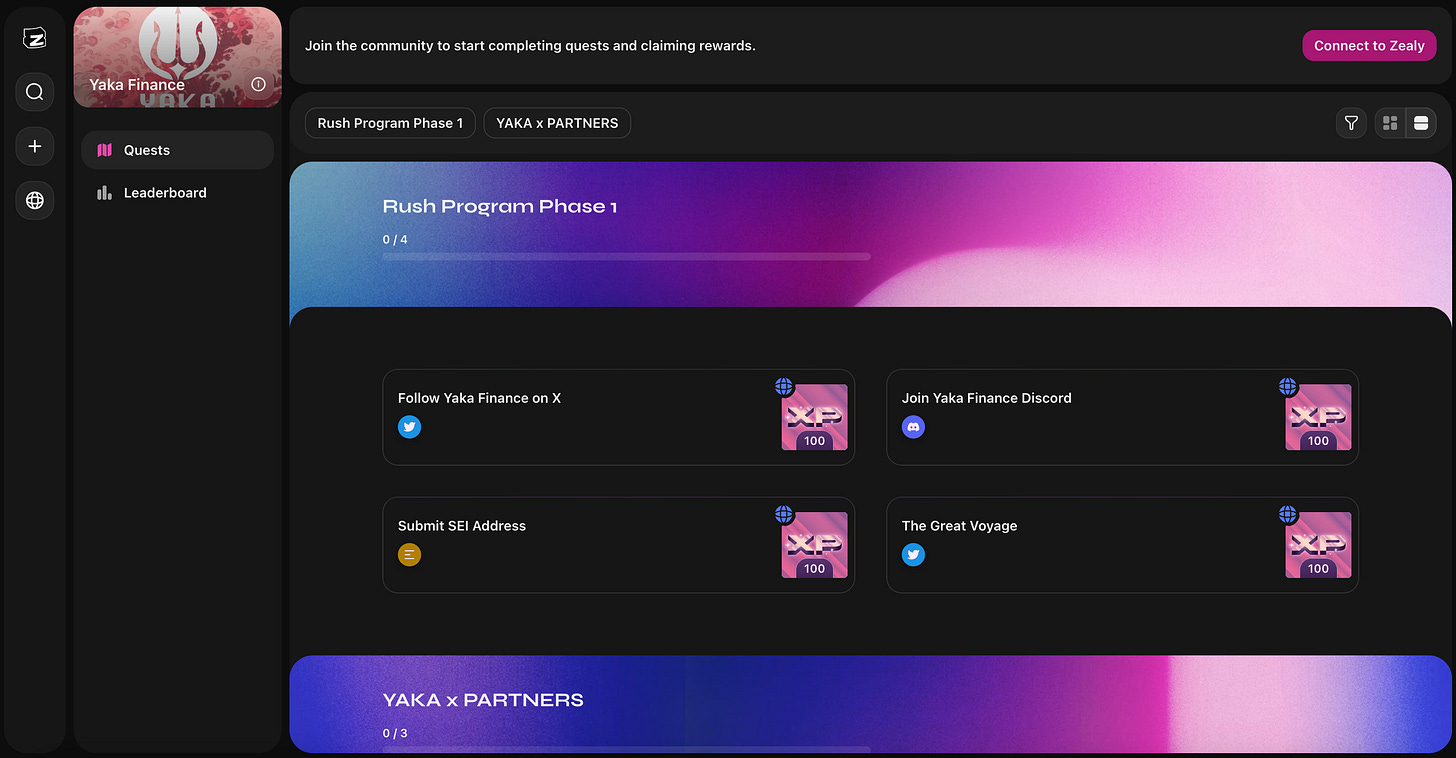

This week marks the final stretch of Yaka Finance's mainnet campaign, set to conclude on August 19 at 12 PM UTC.

During this campaign, 4% of $YAKA's initial supply—equivalent to 8 million $YAKA tokens out of a total of 200 million—will be airdropped as rewards to participating users.

If you haven't yet participated, now is your final opportunity to engage in Yaka Finance's Zealy Social Quests at no cost.

Completing these quests will earn you an equal share of the 1,600,000 $YAKA tokens (20% of the airdrop allocation) that will be distributed among all participants who successfully complete them.

Covalent

Covalent's performance has been notably disappointing over the past month, with a sharp downward trend from $0.2115 on July 15, 2024, to its current price of $0.0599 today.

This decline comes despite its fundamentals remaining largely unchanged since before it migrated from the Moonbeam Network to Ethereum. In some aspects, the project's position could be considered stronger due to its presence on a more robust blockchain.

Beyond the broader market downturn, a very significant factor contributing to this price drop appears to be the actions of an early investor VC, Mechanism Capital, led by Andrew Kang.

According to Arkham Intelligence, the VC has divested its entire holdings of 30 million Covalent tokens ($CXT), valued at approximately $2.59 million then.

Given Covalent's relatively modest market cap of $50.84 million, the liquidation of such a substantial token position inevitably triggered a steep price decline.

Compounding the price pressure were various complications during the $CXT migration journey to Ethereum.

For instance, there were many users and early believers of Covalent who traded on Kraken, which had not halted its trading of the old deprecated CQT token until more than a week later.

With the Covalent team only able to provide Kraken with an equivalent number of new CXT tokens at the snapshot's established time, some users were left stranded, holding on to effectively worthless old CQT tokens.

Regardless of whether responsibility lies with the Covalent team or Kraken, it was ultimately the users who bore the brunt of the consequences. While some may have attempted to capitalize on arbitrage opportunities, others fell victim to inadequate communication and awareness about the ongoing situation.

These events have undeniably eroded trust within the community to some extent, and rebuilding this trust will require concerted effort and time from the Covalent team in the coming months.

It’s my take that despite recent positive developments, such as the partnership with Sei — which promises to integrate Covalent's GoldRush.dev technology stack — the road ahead remains challenging for the Covalent team.

They face the formidable tasks of rebuilding user trust, restoring investor confidence, and maintaining their focus on developing a world-class product.

Achieving these would be crucial for the project's long-term viability and success in the competitive blockchain data space.

Ending Thoughts

As we wrap up this edition of the Alpha Digest, it's crucial to approach the recent recovery with cautious optimism. While encouraging, the market remains volatile, and further price corrections are still possible.

Several key developments are poised to shape the crypto landscape in the coming months. The September US Federal Reserve meeting could bring higher-than-expected rate cuts, potentially impacting global markets and crypto sentiment.

The 2024 US elections are also heating up, with polls tightening between Trump and Harris. This political uncertainty could drive market volatility.

Geopolitically, simmering tensions in the Middle East raise concerns about oil supply, which could spike energy prices and rattle markets.

Despite these short-term uncertainties, I remain optimistic as we move towards Q4 and the US Elections and look ahead to 2025.

However, it's prudent to adopt a conservative approach still.

Always invest within your risk tolerance and consider holding greater stablecoin positions at this time while dollar-cost averaging (DCA) into Bitcoin, Ethereum, and your highest conviction plays.

Be aware that should a dip occur, altcoins would likely experience a sharper drop and be slower to recover than Bitcoin and Ethereum.

This approach will help you weather the market volatility while positioning yourself for long-term growth.

Thank you for your continued support and engagement. If there are specific topics you'd like covered in future editions, please reach out. Your feedback helps shape this newsletter.

Stay curious, stay informed, and stay tuned for the next Alpha Digest.

Cheers,

0xBlockBard

P.S. Follow me on Twitter @0xBlockBard for real-time updates between newsletters!