0xBlockBard Alpha Digest #3

Market Meltdown: Opportunity to Buy The Dip

GM, and welcome to the 3rd edition of my Alpha Digest!

Important: The content in this newsletter is for informational purposes only. It should not be considered financial or investment advice. Cryptocurrency investments are volatile and high-risk. Only invest what you can afford to lose.

Market Overview

Markets opened to a bloodbath on Monday, experiencing one of the worst drops since 2022. The crypto market cap plummeted to a low of $1.78 trillion, representing a staggering 17.68% decline - the largest single-day drop since early 2022.

Although the market had been somewhat fearful and uncertain in the preceding days, few anticipated such a rapid and severe decline within such a short timeframe.

Over $1 billion were liquidated in crypto futures and derivatives, with the majority of losses concentrated in Bitcoin and Ethereum.

A significant factor in this drop was the Bank of Japan's decision to raise interest rates to approximately 0.25% - their second rate hike since 2007 - in an effort to bolster the weakened Yen.

This interest rate hike triggered the unwinding of the Yen carry trade, a strategy where investors borrow Yen at low rates to invest in US Dollars or other higher-yield currencies. According to the Wall Street Journal, Japanese banks had lent approximately $1 trillion to foreign borrowers in yen as of March, a 21% increase from 2021.

As the Yen carry trade becomes increasingly less profitable (as the Yen strengthens against the USD), big players began to dump their USD investments to pay back their JPY loans.

Market Implications and Future Outlook

The critical question now is whether we've already witnessed the worst of this crash or if the market bleeding will continue.

Chris Turner, global head of markets at ING, suggests that the Yen carry trade unwinding may still have some way to go.

The majority of the $1 trillion in Yen lending had been extended to banks and investment firms. These institutions had not hedged against exchange rate fluctuations due to the high cost of hedging and the relative stability provided by the Yen's eight-year period of negative interest rates.

However, as the Yen strengthens, these borrowers are now scrambling to hedge their loans. This necessitates buying Yen, which increases demand and further strengthens the currency, creating a self-reinforcing cycle.

And as the yen gets stronger, more investors who had bet on a weak yen are closing out their bets by buying yen, further adding to its upward momentum.

This creates a 'vicious circle' where the Yen's appreciation triggers more buying, further strengthening the currency in a self-perpetuating loop.

Future Scenarios and Policy Expectations

While the Bank of Japan had initially signaled its intention to potentially continue raising interest rates, depending on economic performance, the recent market crash has sparked widespread criticism.

Critics argue that the bank's action was a poorly timed interest rate hike that has contributed significantly to global market turmoil.

Given the current market chaos and volatility, policymakers at the Bank of Japan are likely to postpone further interest rate increases in the short term.

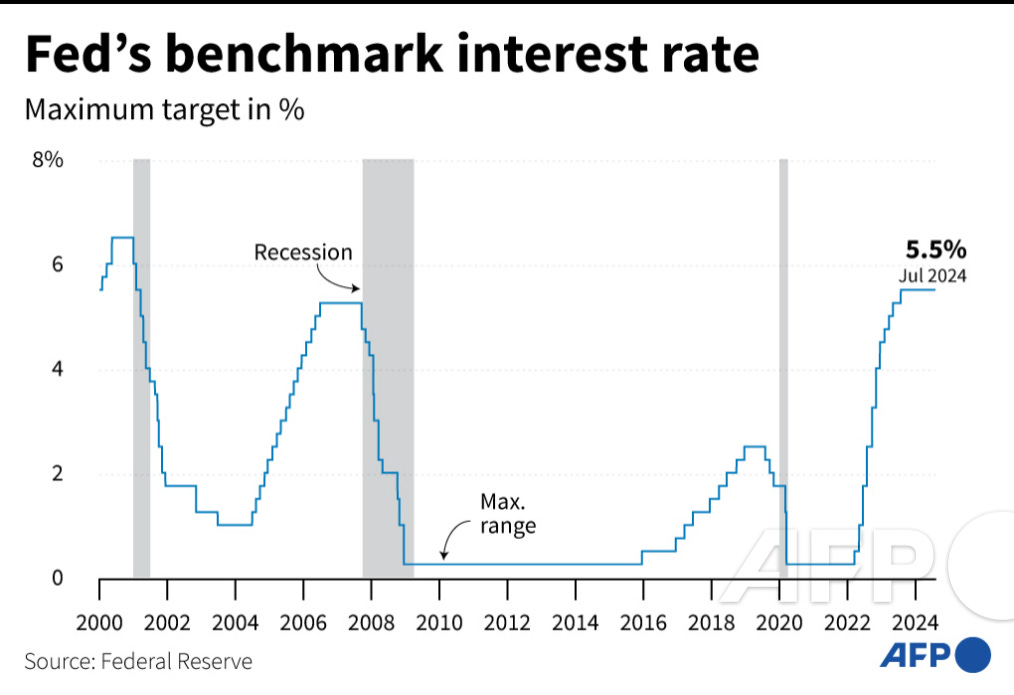

Across the Pacific on the U.S. side, some analysts are speculating and hoping for an emergency Federal Reserve rate cut. The last time an emergency rate cut occurred was on March 15, 2020, at the onset of the COVID-19 pandemic.

Conversely, other analysts argue that such a move would be a knee-jerk reaction. They contend that it would be a mistake for the Federal Reserve to capitulate to current market fears, as doing so could signal deeper economic concerns and potentially lead to even greater volatility.

An alternative and more plausible expectation is that the Federal Reserve might opt for a larger interest rate cut (from 50 to 75 basis points) at its September meeting to stimulate greater economic growth.

Also, while factors such as recession fears, rising U.S. unemployment, and escalating tensions in the Middle East between Israel and Iran are also at play, their impact in causing this market downturn is likely less significant.

Bitcoin and Crypto Market Dynamics

A recent paper, "What Drives Crypto Asset Prices?" analyzes the components driving crypto returns and stablecoin flows, and provides some interesting insights.

The authors, including the Chief Economist at Circle (i.e. USDC), a researcher at Uniswap, and an Assistant Professor of Finance concluded that crypto assets are becoming increasingly interconnected with the global financial system.

The study found that the same factors affecting stock and bond returns also influence cryptocurrency returns. For instance, over two-thirds of Bitcoin's sharp decline in 2022 could be attributed to contractionary monetary policy.

What this implies is that the commonly held view of Bitcoin as a safe haven and hedge against global uncertainty and market volatility, similar to Gold, may no longer hold true anymore.

Investors who previously relied on Bitcoin as a hedge against market downturns may need to reassess their approach and consider alternative hedging strategies to manage their portfolio risk.

Strategies for Navigating the Current Market

Most people, even seasoned investors since 2017, are finding it difficult to navigate the current market - the old crypto playbook seems less effective, and patterns from old cycles no longer seem to apply as strongly as they once did.

At times like this, it’s always a good reminder to go back to basics and stick to fundamentals.

Stay calm and never invest more than what you cannot afford to lose. If you do, fear and panic will begin to cloud your mind and lead to you making suboptimal decisions.

Consider dollar-cost averaging into well-researched projects or high-conviction plays, and do not try to predict or time the market exactly. Nobody knows how the markets will move.

Be patient and do your research. Keep an open mind to what’s going on in the markets and projects you’re interested in, and adjust your decision-making accordingly.

Understand your investment and risk profile; ensure your portfolio is well diversified with risk-return that you are comfortable with

Project Updates

With most altcoins down significantly, it's a good time to consider accumulating high-conviction plays. However, always approach with caution and thorough research.

Personally, I am buying the dip by slowly DCA-ing and mostly accumulating more Ethereum, along with a smaller basket of degen memecoins and altcoins such as Pendle, Covalent, Sui, Sei, and Mantle.

Mini-Spotlight: Hamster Kombat

A project on TON that I’ve been playing in my free time, Hamster Kombat, a free-to-play idle clicker game, has also recently announced that they will allocate 60% of the total token supply for community distribution.

While the exact tokenomics breakdown is not ready, it is expected that the higher your level in the game, the more tokens you will receive.

If you have not started, it’s probably not too late to join and grind a couple levels to qualify for the community airdrop.

Ending Thoughts

The increasing interconnectedness between crypto and traditional financial markets has both positive and negative implications.

On the positive side, it suggests growing mainstream acceptance and integration of crypto, which could lead to increased adoption and potentially more stable long-term growth. It also means that traditional financial analysis tools and strategies may become more applicable to crypto markets.

However, this interconnectedness also means that crypto markets are now more vulnerable to global economic factors and policy decisions. Events like changes in interest rates, geopolitical tensions, or shifts in monetary policy can now have more direct and immediate impacts on crypto prices, as we have just experienced.

This new reality requires crypto investors to broaden their analysis beyond just crypto-specific factors and pay closer attention to global economic trends and policies.

As always, I encourage you to do your own research and consider your risk tolerance before making any investment decisions.

Thank you for your continued support and engagement. If there are specific topics you'd like covered in future editions, please reach out. Your feedback helps shape this newsletter.

Stay curious, stay informed, and stay tuned for the next Alpha Digest.

Cheers,

0xBlockBard

P.S. Follow me on Twitter @0xBlockBard for real-time updates between newsletters!