GM and welcome to the 2nd edition of my Alpha Digest!

Important: The content in this newsletter is for informational purposes only. It should not be considered financial or investment advice. Cryptocurrency investments are volatile and high-risk. Only invest what you can afford to lose.

Market Overview

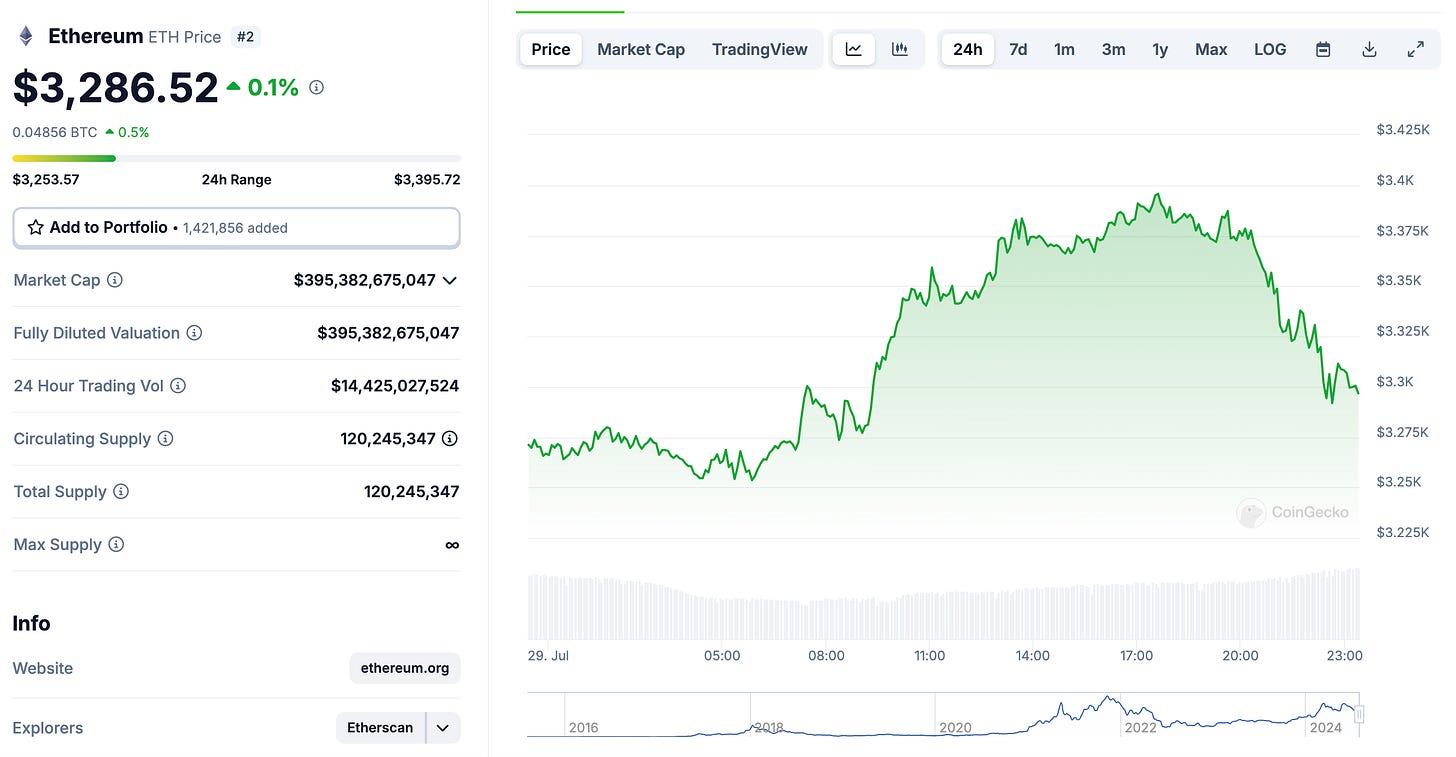

The crypto news this past week has primarily focused on the Ethereum ETF launch on July 24, 2024. According to crypto.news, "throughout the first week, Ethereum ETFs generated a total trading volume of approximately $4.05 billion, compared to $7.85 billion for Bitcoin ETFs in their initial week."

Given that most investors had anticipated and priced in the Ethereum ETF news in the weeks leading up to the launch, it's not surprising that a sell-the-news event occurred. Ethereum prices dropped about 10% throughout the past week, reaching a low of $3,098 on July 26 (though they have since largely recovered to around ~$3,286 at the time of writing).

A significant portion of the selling pressure came from net outflows from the Grayscale Ethereum Trust (ETHE). This trust, initially launched in 2017, was only available to accredited investors and subject to a 6-month holding period with high fees of 2.5%. The launch of the Ethereum ETF has allowed investors to more easily move their funds to cheaper alternatives.

Unsurprisingly, Grayscale has recently launched a new Ethereum Mini Trust Fund (ETH), offering 0% fees for the first 6 months, after which fees will be 0.15%. Overall, the launch of the Ethereum ETF is positive news for the wider crypto market, as it more closely integrates with the traditional finance world, which is still about 46 times the size of the crypto market cap ($111.85T vs $2.43T).

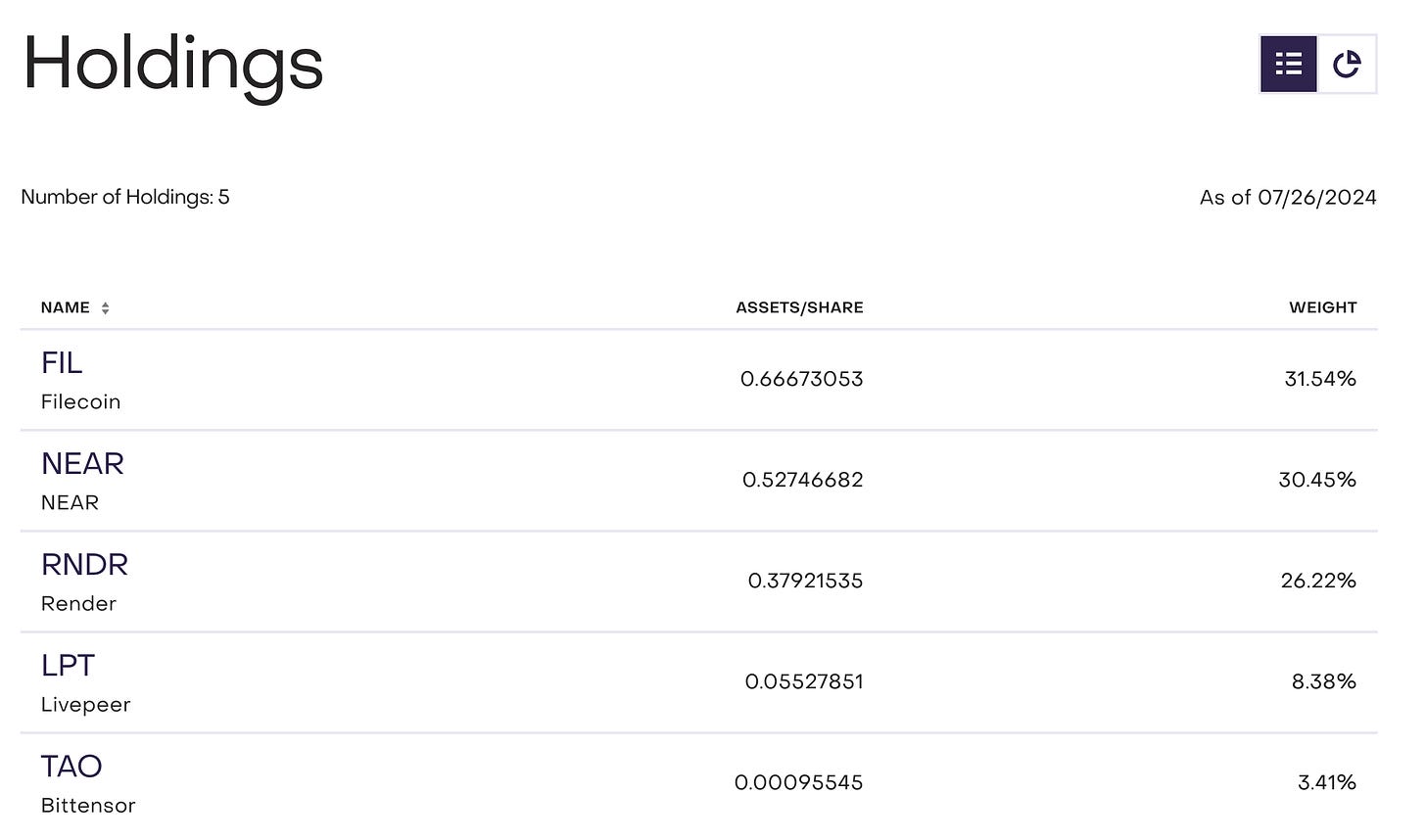

Decentralised AI Fund

Additionally, Grayscale launched a new Decentralized AI Fund on July 17, 2024, focusing solely on crypto and web3 projects that integrate Artificial Intelligence and DePIN (Decentralized Physical Infrastructure Networks) technologies.

Currently, the fund’s holdings are fairly conservative, with the main AI and DePIN projects - Filecoin, NEAR, and Render - comprising the lion’s share.

Grayscale will rebalance its investment portfolio quarterly. Potential contenders that I believe could be added to their portfolio include The Graph ($GRT) and Arweave ($AR).

Overall, this indicates a positive medium to long-term outlook for the crypto AI and DePIN space.

Pendle Buying Opportunity

One of my missed trades, which I try not to dwell on too much, was Pendle when it was still trading at about $1. At the time, I was too preoccupied with my full-time work and other side projects to stay focused in managing my investment portfolio.

Pendle prices have dropped by about 36% over the past month and 45% from the May highs of approximately $7.2. If you've missed out on Pendle in the past or simply want to accumulate more, now might be a good time to DCA (dollar-cost average) in.

But don't just take my word for it. Hashkey Capital, known for its strong track record in trading $PENDLE, purchased 583,000 $PENDLE tokens for approximately $2.2 million on July 26 (at an average price of ~$3.77). This move comes after Hashkey Capital realized about $9.96 million in profits from $PENDLE trades in May.

Projects I’m Watching

Here are some projects that I believe have potential in the medium to long term:

LNQ AI

LinqAI ($LNQ - $0.262) is a cryptocurrency project that integrates artificial intelligence (AI) with the Web3 ecosystem to automate various business processes. The primary goal of LinqAI is to enhance operational efficiency by automating mundane tasks traditionally performed by human employees, allowing businesses to focus on more complex and creative challenges.

Their first product, Marketr V1, is nearing completion. It's essentially a Marketing-AI SaaS tool that generates end-to-end marketing campaigns with automatic social media posting, and with learning capabilities to optimise future output.

Based on the demo video and screenshots, Marketr looks to be a sleek and fairly comprehensive software that could be prove to be a sustainable business solution, and more importantly, beyond the crypto markets as well.

Cygnus Finance

Cygnus Finance is a RWA (Real World Asset) stablecoin protocol on Base that pioneers cgUSD, a native interest-bearing and anti-inflation stablecoin. cgUSD is rebased daily and backed by short-term U.S. Treasury bills as collateral.

Essentially, users can earn a competitive APY (currently 5.3% through USDC on Base) simply by holding cgUSD in their wallets. At present, the protocol has $78.46M in total value locked (TVL) and $479,178.08 in accumulated interest.

Users can mint cgUSD using either USDC or USDT on Base, Ethereum, Arbitrum, Optimism, and TON. However, some chains are not yet fully operational, as indicated by pending contract addresses in their documentation.

Last week, Cygnus Finance announced a boost to $cgUSDT, offering a 30% APY on the TON blockchain with Tether's support. Users simply need to deposit USDT to receive $cgUSDT here. Currently, there are $44,839,801 in total assets locked in this offering.

Yaka Finance

Yaka Finance has entered the second week of its mainnet Points program, where participants earn points for on-chain actions such as swaps and providing liquidity to their pools

The campaign runs for one month, from July 19 to August 19. Additionally, the Yaka Finance team is set to receive another grant from Sei following this mainnet launch, which bodes well for their upcoming TGE (Token Generation Event).

As mentioned in my previous newsletter, I've begun farming points using Yaka Voyagers and other partner NFTs that I purchased.

To be frank, interacting with the Yaka Finance site was somewhat clunky. There appear to be several bugs and issues that the team needs to address to improve the user experience.

The swap exchange from Sei to USDC or USDT was suboptimal, with relatively high slippage. Nevertheless, I proceeded with a swap of about 2,000 Sei (approximately $750) to earn points, which I then deposited into their stable pools.

To my dismay, the points were not recorded for this transaction, and I didn't earn any points from the swap. The current 13.01 points reflected only an earlier $100 swap I had done the previous day as a test.

Support on Discord has not been the most responsive. I created a ticket but had to resort to posting about my issue in the Voyagers NFT chat to get the moderators' attention. The issue has apparently been passed on to the team, but I'm prepared to write off the missing points as a loss in any case.

For those still interested in participating, I recommend performing swaps on larger Sei DEXes like Dragon Swap, and then providing liquidity to the Yaka Finance pools.

Resources

I recently discovered an excellent Airdrop farming journal created by ShawnFarms, which I felt compelled to share with all my readers

Lots of high potential airdrop opportunities to explore, and remember it’s never too late to get started.

Ending Thoughts

As we've seen from this week's highlights, the crypto space never sleeps. From the launch of Ethereum ETFs to innovative projects like LNQ AI and Cygnus Finance, there's no shortage of developments to watch.

The Pendle situation also serves as a reminder that timing and vigilance are crucial in this market. As always, I encourage you to do your own research and consider your risk tolerance before making any investment decisions.

Thank you for your continued support and engagement. If there are specific topics you'd like covered in future editions, please reach out. Your feedback helps shape this newsletter.

Stay curious, stay informed, and stay tuned for the next Alpha Digest.

Cheers,

0xBlockBard

P.S. Follow me on Twitter @0xBlockBard for real-time updates between newsletters!

Wow. Enlightening piece, buddy.