0xBlockBard Alpha Digest #1

Crypto's Wild Ride: What's Hot and What's Next

Wow, the crypto world has been on a wild ride since my last deep dive.

I owe you all an honest explanation - I've been knee-deep in other projects and, I admit, battling a serious case of procrastination. But I'm back now, and the crypto landscape is too exciting to ignore.

So, here's the plan: I'm kicking things off with a weekly alpha newsletter. I'll be sharing the projects that have caught my eye - the ones I believe have real potential to make waves in the medium to long term. Think of it as a curated peek into my crypto watchlist.

And for those of you who've been missing the deep dives, don't worry. I'm aiming to release at least one in-depth report each week, depending on how complex the project is. Some weeks I might manage multiple deep dives, others I might only produce one - but I promise that whenever I do release a report, it'll be thorough and insightful.

Important: The content in this newsletter is for informational purposes only. It should not be considered financial or investment advice. Cryptocurrency investments are volatile and high-risk. Only invest what you can afford to lose.

Market Overview

The market has been making erratic moves over the past couple of weeks. Just two weeks ago, some influencers were extremely bearish when the markets dipped as Germany dumped its bitcoin holdings.

Bitcoin prices had dropped to $54k and Ethereum to $2.8k; I hope you guys managed to buy on this dip. If not, it’s probably not too late to slowly DCA your way in now. The medium to long-term forecast is pretty optimistic, with a crypto-supportive Trump administration expected to win in November 2024.

Looking at the Tether Dominance chart, USDT dominance has dropped from ~5.4% in early July during the dip to ~4.76% now, indicating increased deployment of capital into crypto projects.

On L2s, the Blast L2 had a good run-up to their airdrop on June 26, 2024. However, amid unclear communication and delays, investors' expectations weren't met, not to mention many users were misidentified as sybil bots, resulting in general discontent.

TVL on the Blast Network has dropped from ~$2.3B on June 6, 2024 to about ~1.3B today.

Does this mean Blast is out of the L2 game? I don’t think so, as Pacman, the founder of Blur and Blast has a solid track record in understanding crypto web3 users behaviour. It's likely only a matter of time before Blast moves beyond the oversaturated airdrop meta and adapts to the next hype cycle.

Base L2 is still going steady, and I’m enthusiastic about exploring frames on Farcaster (follow me here if you’re on Warpcast). There is a lot of potential and I’m on the lookout for good memecoins to enter after $BRETT and $TOSHI.

One L2 I'm particularly optimistic about is the Sei Network. It's been around for a while but was mostly ignored as people flocked to Arbitrum, Optimism, Blast, and Base in search of airdrops and points.

With the recent Sei V2 launch, which introduces a high-performance parallelized EVM, transaction finality is expected to significantly improve to sub-second levels, similar to high-performance blockchains like Solana.

Not many influencers are talking about Sei right now, but I expect this to change in the coming months if the trend continues. I would expect Sei to enter the mainstream crypto-twitter narrative soon. You heard it here first!

Projects I’m Watching

Here are some projects that I believe have potential in the medium to long term:

Covalent

Covalent is a modular data infrastructure and decentralised network started in 2018 providing access to on-chain data over 200+ blockchains.

The project has raised a total of over $20M from token sales to date, with the latest round making the news with a raise of $5M in strategic funding from a Series B on June 26, 2024.

In addition, the high-profile Arthur Hayes (Co-Founder of BitMex and Chief Investment Officer at Maelstrom) has joined the team as a Strategic Advisor and will receive compensation in CXT tokens.

One major solution the team is working on is the “Ethereum Wayback Machine” or EWM for short, with the EWM testnet set to release in Q3 2024. The EWM offers perpetual access to all historical data on Ethereum and supported L2 chains, without which L2 rollup data (containing records of transactions) are only stored and available for about 18 days before being discarded.

As crypto becomes more mainstream in the future, and with increased user growth (i.e. from lower gas fees, more real world applications etc), there will be increasingly more transactions on the blockchain.

This underscores the importance of having complete data sets for historical data on any blockchain, which can be used for multiple use-cases such as tax compliance tools, DEX analytics, and NFT dashboards among others.

Covalent has recently migrated their CQT tokens from the Moonbeam Network over to the CXT tokens on the Ethereum Mainnet, which in my opinion could have been better handled. Currently, many holders are still facing some issues after the migration, with many on several exchanges such as Kraken and Kucoin yet to receive their CXT tokens.

While Kucoin has agreed to support the migration, Kraken still allowed trading for the CQT tokens after the migration, which led to many disgruntled users who thought they were buying Covalent tokens for cheap.

Recently, Kraken announced that they would exchange CQT tokens for CXT tokens at a 1-1 ratio based on the 12 July snapshot. (Disclaimer: I am one of those who held about $1k worth of CQT tokens on Kraken before the snapshot, and I am still waiting for the migration to happen.)

While $CXT price surged up to $0.237 last week, it has since retraced back to $0.14, which was approximately its price before the migration. While there is still some FUD because of ongoing migration teething issues, I believe that once it is settled and with their ongoing developments, Covalent’s CXT price will stabilise at a higher level.

I will be releasing a deep dive report on Covalent soon for those who are interested to find out more about this project!

Yaka Finance

Yaka Finance is positioned as the native liquidity engine of the Sei Network, and operates as a decentralized exchange (DEX) and launchpad, utilizing a ve(3,3) model to optimize liquidity and facilitate trading within the Sei ecosystem.

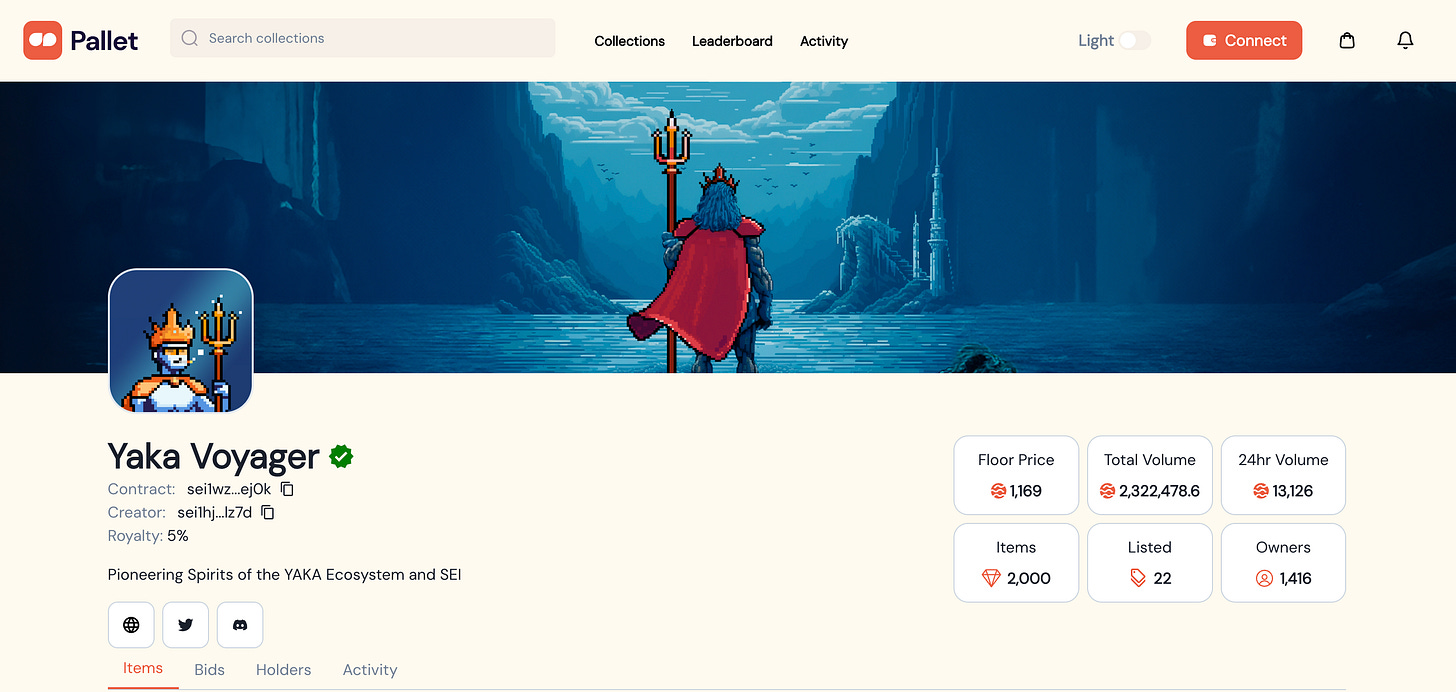

What’s interesting about Yaka Finance is its integration of Yaka Voyager NFTs into its business model. These NFTs offer minters and stakers a share of the Yaka token airdrop and DEX trading fees, aligning holders with the project's long-term interests.

Currently, Yaka Finance is running an airdrop campaign from July 19, 2024, to August 19, 2024. 8,000,000 points are up for grabs, corresponding to an airdrop of 8,000,000 in $YAKA tokens. The Token Genesis Event (TGE) hasn't occurred yet, so there's no price set for $YAKA.

With Yaka Finance's mainnet launching just a week ago, there's plenty of time to start farming for their airdrop. Participation options include:

Zealy Social Quests (20% or 1,600,000 points): Earn points by following partner Twitter accounts. Participants who completed ALL Zealy Social Quests will equally share 1,600,000 points.

Trading (10% or 800,000 points): Points allocated based on swap volume. 25,000 points will be allocated daily based on users’ transaction volume (in USD).

Liquidity Provision (70% or 5,600,000 points): Earn points by providing liquidity to Yaka Finance. 175,000 points will be allocated daily based on users’ deposit amounts (in USD).

NFT Multipliers: Hold Yaka Voyager and partner NFTs for point boosts (for example, 37.5% with one of each). You can get up to 65% boost with 5 Yaka Voyagers; however, I think that would be out of budget for most people.

For more detailed information about their points program, you can check out their medium article here.

(Disclaimer: I’ve bought a couple Yaka Voyager NFTs and Redmilio NFTs a while back too. Currently, the floor price for Yaka voyagers is at 1169 Sei ($463.83) and 87 Sei ($34.52) for Redmilio.)

Ending Thoughts

The crypto landscape continues to evolve rapidly, presenting both challenges and opportunities. As we navigate this dynamic environment, it's crucial to stay informed, diversify wisely, and always conduct thorough research before investing.

I'm excited to continue exploring and sharing insights on promising projects and market trends. Stay tuned for more in-depth analyses, and remember, in the world of crypto, knowledge truly is power.

Thank you for your continued support and engagement.

Ready to ride the next bull-run wave together?

Buckle up and stay tuned!